Category Fit: The Secret Ingredient to Successful Retail Expansion

A few months ago, a brand selling OTC pill cases and bandages asked us to get them into Bloomingdale's. The brand had traction. The products were well-reviewed. They had operational capacity to scale. On paper, they were ready for retail expansion.

But Bloomingdale's was the wrong answer.

Not because the retailer wasn't prestigious. Not because the products weren't good enough. The issue was simpler and more important: the category didn't fit.

Bloomingdale's sells fashion, luxury goods, beauty, and home décor. Their buyer teams are organized around those categories. Their customers walk in expecting a curated lifestyle experience, not OTC first-aid consumables like pill cases and bandages. There was no natural home in the store, no adjacent category, no logical shelf or peg placement, and no existing customer intent. And the metrics the buyer cares about—adjacency, margin per square foot, and sell-through in beauty and home—don't map to low-ticket, high-replenishment first-aid items.

We told them no. They pushed back. We held our position. Then we mapped the category and redirected the work toward channels where first-aid actually has a home—drug chains and safety assortments like Zoro's first-aid category. Saying no early saved months of pitch prep and packaging tweaks for a buyer who didn't have a shelf to put them on.

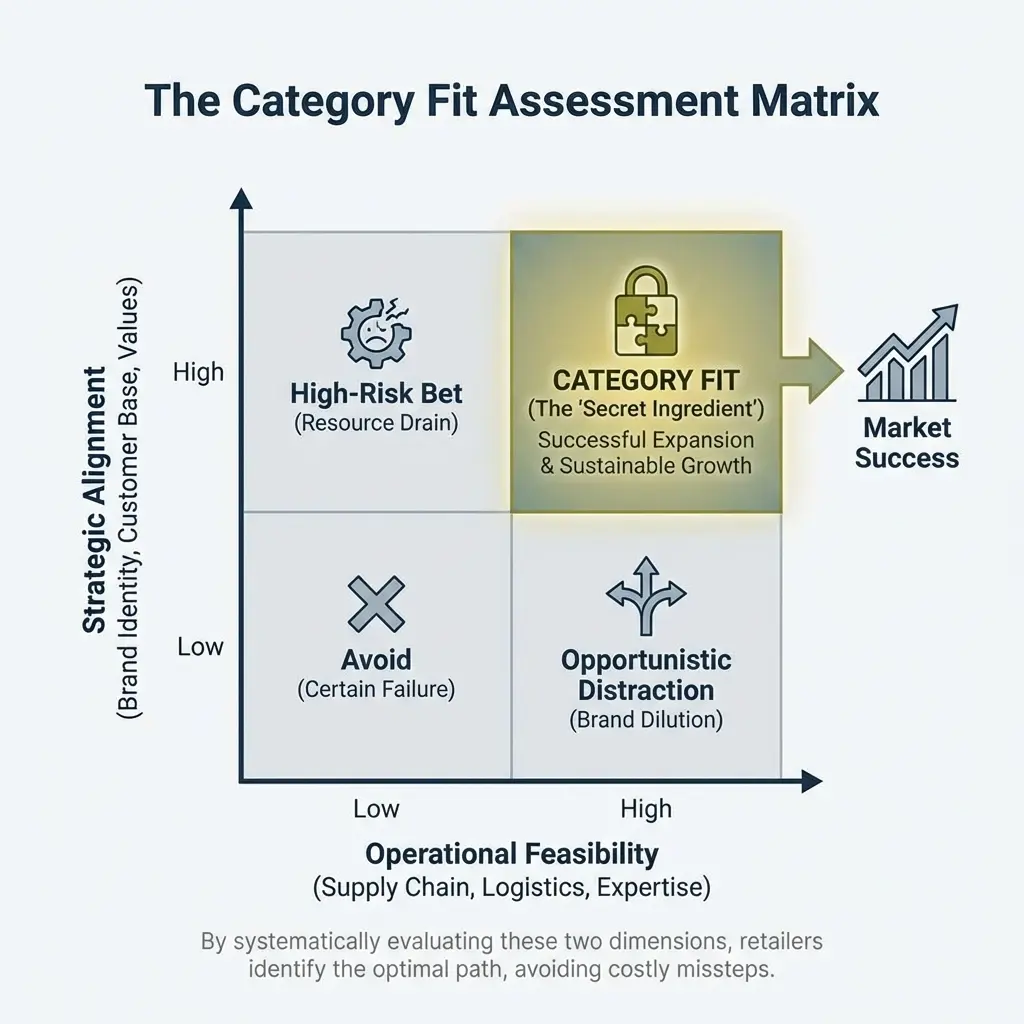

Why Category Fit Determines Whether You Get In, and Whether You Succeed If You Do

Retail buyers aren't talent scouts. They're category managers with specific mandates: grow their section, maintain margin, reduce risk, keep the assortment relevant. When they evaluate a new brand, they're asking a narrow set of questions:

- Does this product belong in a category I manage?

- Will it sell through at the velocity I need?

- Does it complement or compete with what I already carry?

- Can this brand meet my compliance, logistics, and margin requirements?

If your product doesn't clearly answer the first question, the rest of the conversation doesn't happen.

This is where ambition gets in the way. Brands see a retailer's prestige or scale and assume that's the prize. But prestige doesn't create category alignment. A product that's wrong for the assortment will either get rejected outright, or worse, get accepted and then fail to perform, burning the relationship for future opportunities.

Category fit isn't about whether a retailer is "good enough" for your brand. It's about whether your brand is operationally and strategically relevant to that retailer's customer base.

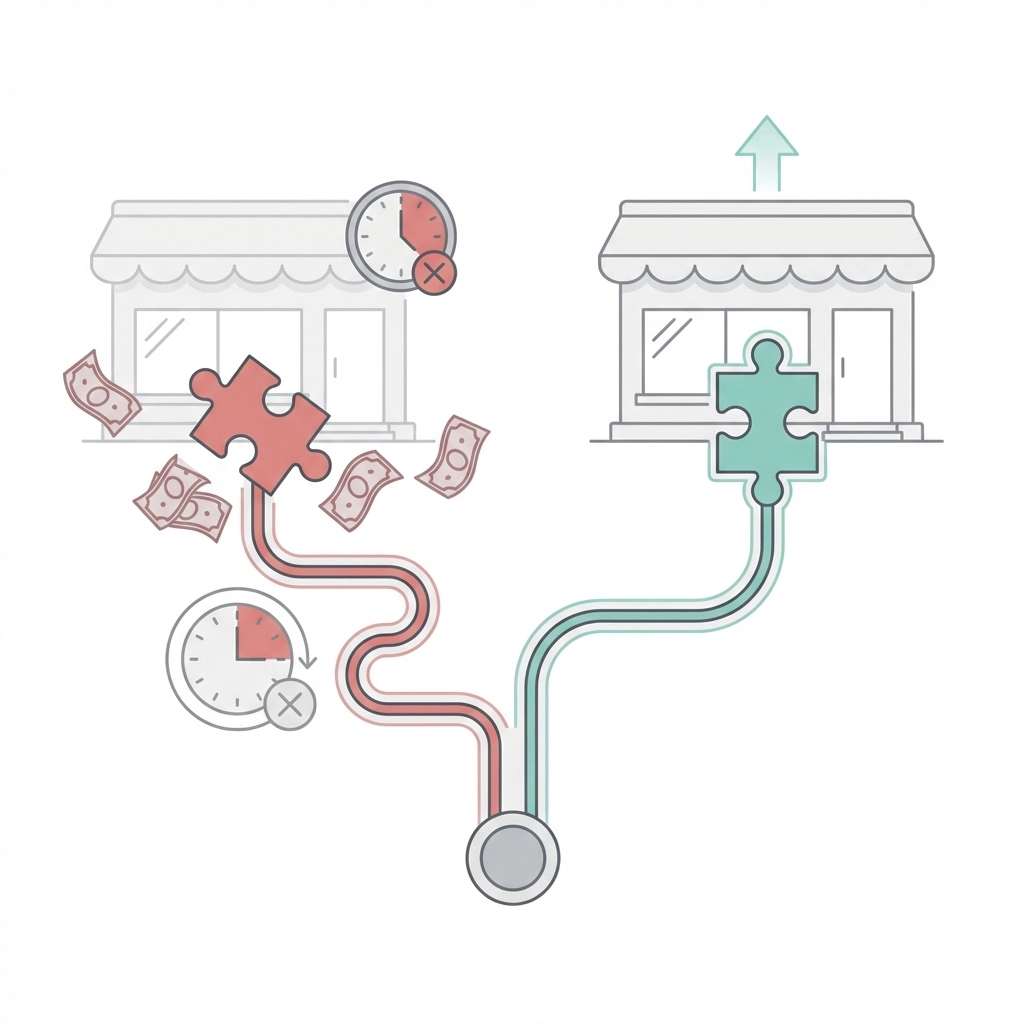

The Real Cost of Misaligned Retail Pitches

Pursuing the wrong retailer isn't just a dead end. It's expensive.

Time spent preparing pitch decks, building retailer-specific packaging, negotiating terms, and setting up EDI integrations is time you're not spending on retailers where you actually have a path. We've seen brands burn three to six months chasing a retailer that was never going to convert, because the category team didn't even exist for their product type.

"One brand selling crystal servingware had spent nearly $18,000 in samples, trade show fees, and logistics prep for a pitch to Macy's. They saw Macy's as the natural home for upscale tableware—the kind of retailer that matched their brand positioning. The buyer took the meeting, was polite, and passed. The feedback: 'We don't carry this category depth online anymore, and our tabletop assortment is already saturated.' We redirected them to Home Depot. Not the obvious choice for crystal, but Home Depot was actively expanding their online home decor and entertaining categories, had buyers looking for differentiated products, and their customer base included the exact demographic buying serving pieces for outdoor entertaining. Home Depot accepted them quickly. The brand got in because the category fit was right, even though the retailer wasn't their first instinct."

Signs a Retailer Is a Good Category Fit

Category fit isn't always obvious from a retailer's homepage. You need to dig into how they organize their assortment, what categories they're actively expanding, and where your product would physically or digitally live.

Here's what we look for:

The category already exists. This sounds obvious, but it's often overlooked. If the retailer doesn't have a dedicated section, or buyer, for your product type, you're not pitching a new opportunity. You're asking them to invent one.

Your product fills a gap, not a duplicate. Buyers aren't looking for another version of what they already carry. They want assortment depth, price tier coverage, or feature differentiation. If you're bringing a product that mirrors their current top seller, the answer is almost always no.

Customer intent aligns. Why do people visit that retailer? What are they looking for? A customer shopping at Zoro has different expectations than one browsing Wayfair. Your product needs to match the intent the retailer has already cultivated.

The retailer is actively growing the category. Some categories are in maintenance mode: stable, low-priority, and not open to new vendors. Others are being actively expanded. Knowing the difference changes whether your pitch lands on a buyer who has bandwidth or one who doesn't.

Signs a Retailer Is a Bad Fit

You have to explain why you belong there. If the pitch requires a paragraph justifying why your product makes sense in their assortment, that's a signal. Strong fits are self-evident. The buyer sees your product and immediately knows where it goes.

Your product requires education. Retailers with high-volume, low-touch sales models: think big-box stores or general marketplaces: aren't built for products that require explanation. If your product's value proposition depends on a knowledgeable sales associate or a detailed product page, you need a channel that supports that.

You're chasing the logo. This is the most common trap. The brand wants to say "we're in [major retailer]" for credibility. But if the fit isn't there, the placement either won't happen or won't perform. A vanity placement that sells 40 units a month isn't a win: it's a liability.

When Category Fit Is Right, the Path Is Clear

Lighting Hub came to us wanting Bed Bath & Beyond. It made sense from their perspective—BB&B carried lighting, their products fit the home goods aesthetic, and the brand recognition would be valuable.

We pushed them toward Zoro instead. Zoro's buyers were actively expanding commercial and contractor-focused lighting categories. The customer base was facilities managers and small business owners, not residential consumers. Lighting Hub's product line—functional, durable, price-competitive—was exactly what Zoro's assortment needed.

The difference wasn't product quality or operational capability. It was category alignment. Zoro had the gap Lighting Hub could fill. BB&B didn't.

What Happens When Brands Chase Big Names Instead of Good Fits

We've seen this pattern repeatedly:

- Brand identifies a high-profile retailer.

- Brand invests in pitch prep, samples, compliance, packaging.

- Brand gets a meeting: or doesn't.

- If they get in, the product underperforms because the customer base isn't aligned.

- Retailer deprioritizes the brand or terminates the relationship.

- Brand loses credibility for future pitches.

The damage isn't just financial. It's reputational. Retail buyers travel from company to company. If you've failed to perform at one retailer, that history follows you. And re-approaching a retailer after a failed first run is harder than getting a meeting the first time.

The goal isn't to be in retail. The goal is to be successful in retail. Those are different outcomes with different strategies.

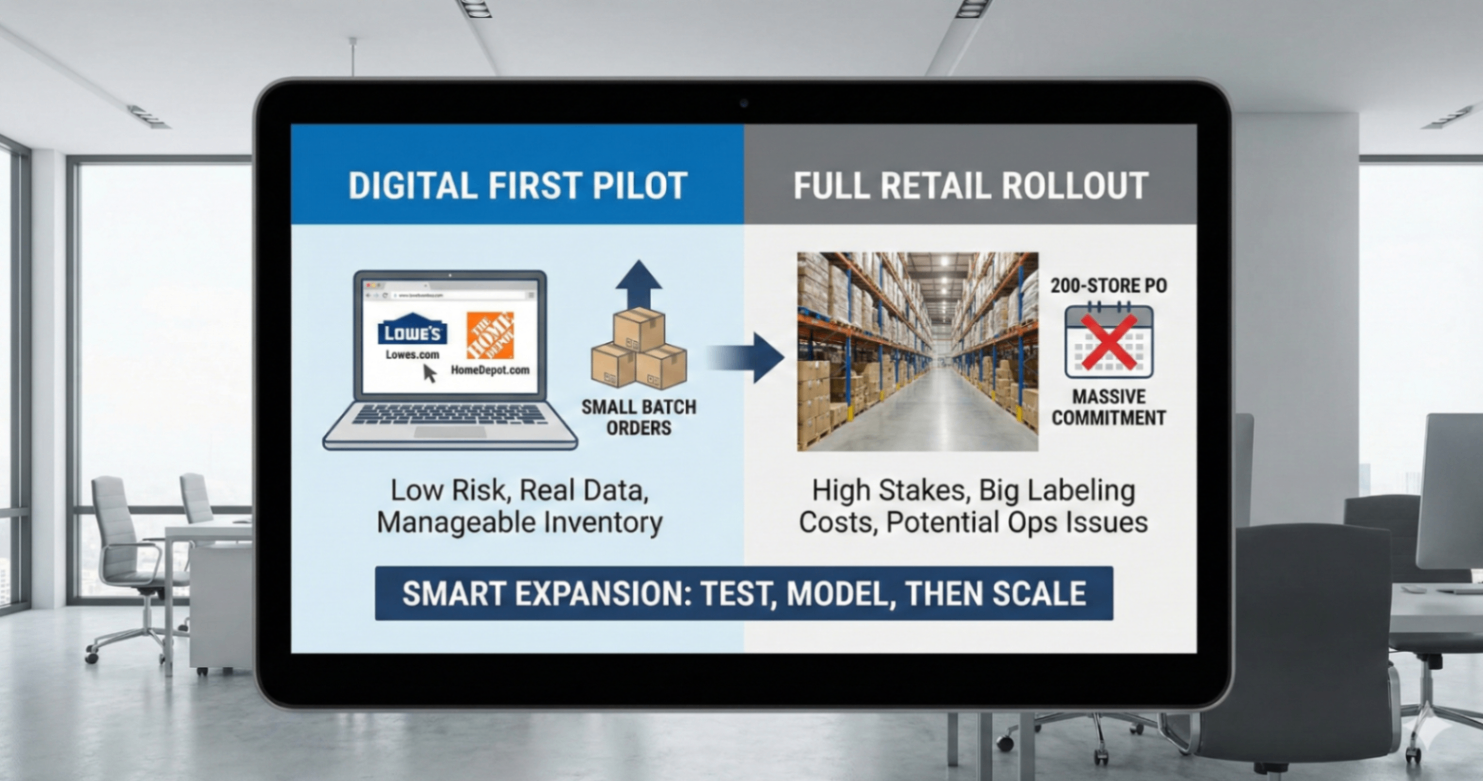

How We Evaluate Retailer Fit for Clients

When a brand comes to us with a list of target retailers, we don't start with outreach. We start with fit analysis.

Category mapping. We look at how the retailer organizes their assortment. Does a category exist for this product? Who manages it? Is it growing, stable, or contracting?

Competitive positioning. What does the retailer already carry in this space? Where does the brand fit in terms of price, features, and brand positioning? Is there a gap, or is the assortment already full?

"When we evaluated Core Tarps for retail expansion, the competitive positioning analysis was straightforward: they made industrial-grade tarps and covers at price points between economy options and premium brands. Home Depot's assortment was heavy at both ends but thin in the mid-tier contractor segment. Lowe's had a similar gap. Zoro needed depth in commercial applications. The positioning analysis told us exactly where Core Tarps belonged—and where they'd struggle. They didn't need to be everywhere. They needed to be where the gap existed."

Customer alignment. Who shops at this retailer, and what are they looking for? Does the brand's value proposition match that intent?

Operational fit. Can the brand meet the retailer's compliance, EDI, logistics, and margin requirements? Some retailers are more demanding than others. A good category fit with a bad operational fit still results in failure.

We've talked brands out of pursuing retailers they were excited about. We've also surfaced retailers they hadn't considered: ones where the category fit was strong and the path to entry was more direct.

The Decision You're Actually Making

Choosing which retailers to pursue isn't just a marketing decision. It's a resource allocation decision.

Every retailer you target requires time, capital, and operational bandwidth. You can't pursue all of them simultaneously: and you shouldn't. The brands that scale successfully are the ones that prioritize fit over prestige, sequence their expansion strategically, and invest in relationships where the category alignment is already strong.

If you're evaluating retail expansion and aren't sure whether your target list is realistic, that's a conversation worth having. We help brands assess retailer fit before they invest in outreach: so the pitches that go out are the ones most likely to convert.