EDI for Retail: Complete Guide for E-Commerce Brands

Picture this: you're 18, starting your first role at a company that supplies major retailers. Your manager mentions "EDI," everyone nods, and you nod too—while quietly wondering, "what exactly is EDI, and why does everyone treat it like table stakes?"

Good news: EDI is less mysterious than it sounds.

Quick Take: EDI (Electronic Data Interchange) is how businesses exchange standard documents automatically—without people retyping data. Think of it as system-to-system messaging for purchase orders, invoices, and shipping notices.

If you’re evaluating EDI integration or comparing retail EDI software, start by clarifying your EDI requirements for retailers. For a broader view of channel readiness, see our retail readiness approach.

EDI: The Quiet Backbone of Retail Operations

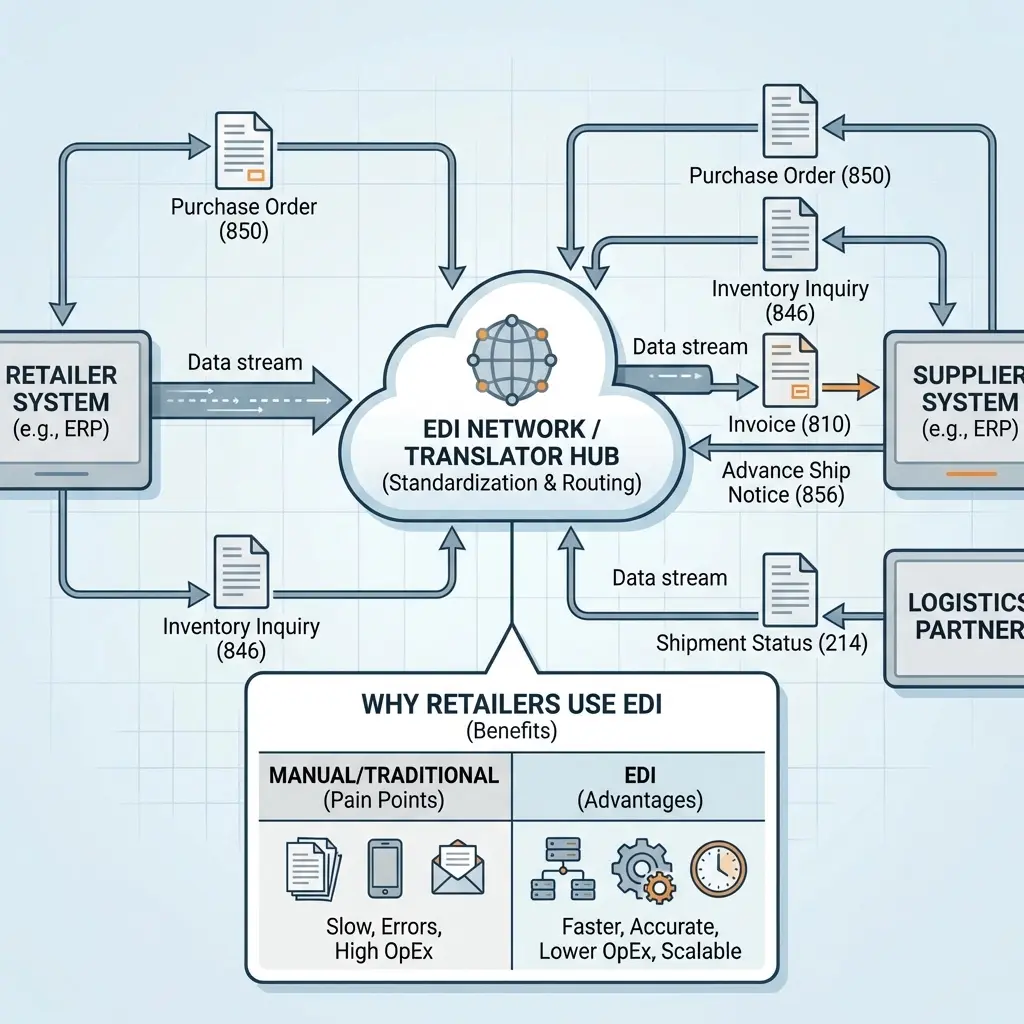

EDI stands for Electronic Data Interchange. At its core, it’s systems communicating in a shared, structured format to move business documents automatically.

A practical example: when Home Depot orders 500 units of your LED bulbs, their system generates a purchase order, translates it into a standard format (often ANSI X12), and transmits it to your system. Your system ingests it, creates the order, and returns an acknowledgment—no manual keying in the middle.

No emails, phone calls, or faxing—just automated data exchange.

The documents that typically move via EDI include purchase orders, invoices, advance shipping notices, inventory updates, and payment confirmations. In other words, the operational paperwork—digitized and automated.

What differentiates EDI from emailing attachments is standardization. Each EDI document follows strict formatting rules, so a Home Depot purchase order looks the same whether it’s going to you, Black & Decker, or any other supplier. That uniformity is what enables automation.

EDI vs. API: What's the Practical Difference?

You might ask, "Don't APIs handle this now?" Both EDI and APIs move data between systems, but they operate differently.

EDI is closer to a formal business letter: structured, standardized, and often processed in batches. Many teams schedule EDI transmissions—say, all POs at 6 PM—because it's reliable and predictable.

APIs function more like a live conversation. They're real time and flexible, which is why checking inventory on Shopify returns an answer immediately.

Reality check: Most major retailers still require EDI because it is built for high-volume, standardized transactions. APIs are excellent for real-time queries and dynamic interactions; EDI is built for throughput and consistency.

What this means operationally: if you plan to sell into Home Depot, Lowe's, or most enterprise retailers, you will need EDI capability. Decision: budget for EDI as required infrastructure, then decide whether to build, buy, or rent it.

One caution we see often: teams try to simulate “EDI” with emailed PDFs and spreadsheets. It can limp along—until the first compliance sweep or the first 23 oversold units. Stand up real EDI early; the cost is lower than chargebacks and cleanup.

How Retailers Actually Use EDI

Practically, here’s how this shows up with real retailers.

For eCommerce operations, retailers like Zoro, Ferguson, and Amazon Business use EDI to manage large volumes of B2B orders. A contractor places a 200-unit junction box order on Zoro; the order flows via EDI to the supplier, is processed, and triggers automated shipping notices back to Zoro and the buyer.

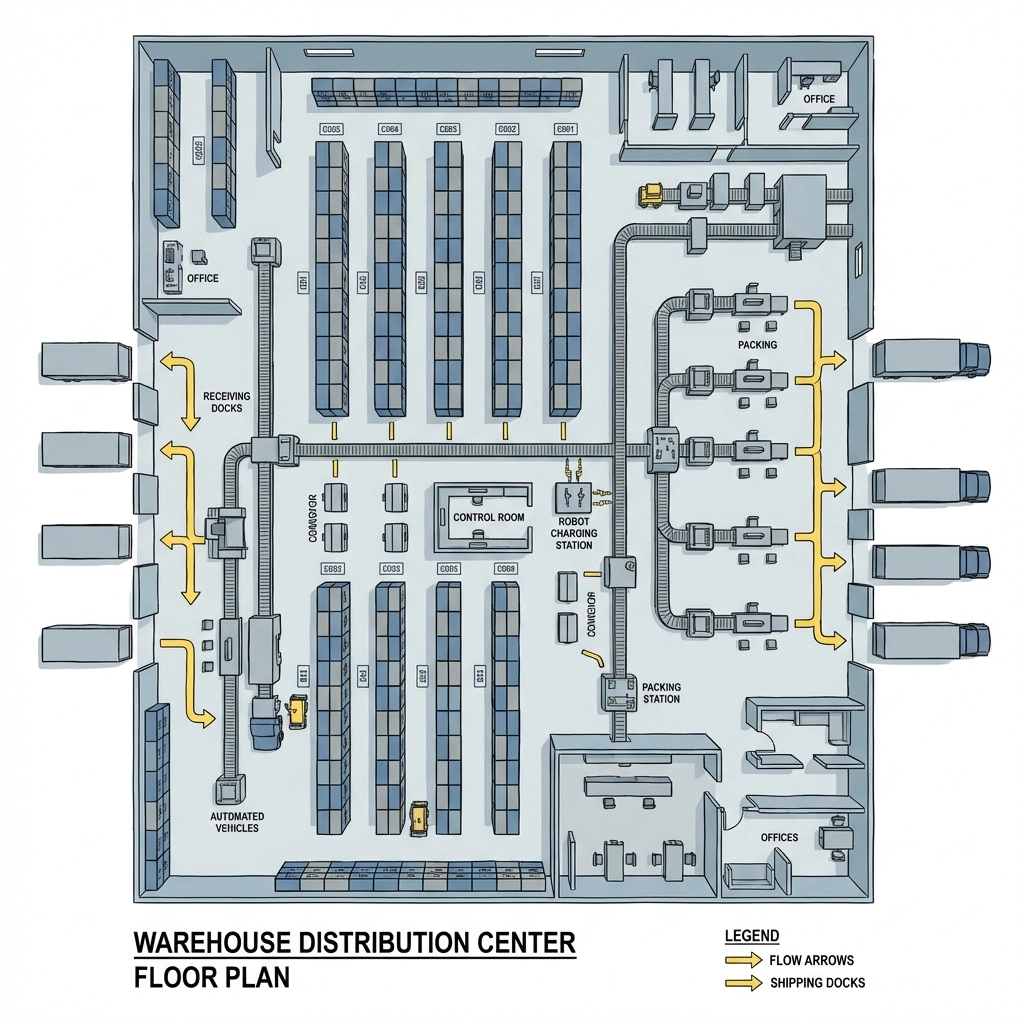

For brick-and-mortar, consider Home Depot’s thousands of stores. Local inventory systems generate replenishment orders as stock drops. Those orders flow via EDI to suppliers, who ship to distribution centers or stores. The loop from "inventory low" to "shipment confirmed" runs without manual touch.

The scale is large. A single enterprise retailer may process hundreds of thousands of EDI transactions per day across suppliers. That volume rules out email and spreadsheets.

EDI chargebacks reinforce compliance. If a supplier is required to send an advance ship notice via EDI and fails to do so, retailers assess fees—often $50–$500 per violation. Repeated misses can lead to suspension or removal from the supplier base.

This isn’t posturing. Coordinating inventory across thousands of locations and millions of SKUs demands automation.

EDI Readiness: Quick checklist

> - Confirm documents you’ll support: 850 (PO), 855 (PO acknowledgment), 856 (ASN) with carton/pack hierarchy, 810 (invoice), plus 997 (functional acknowledgment).

> - Labeling capability: GS1-128/SSCC labels printed at the ship node; ensure UCC-128 data ties to carton IDs in the ASN.

> - Define ship nodes, lead times, and routing (DC vs. store) per retailer.

> - WMS/3PL integration in place (e.g., SkuVault, ShipStation, 3PL portals) to feed pick/pack/ship events.

> - Assign ownership for monitoring 997/824 rejects, clearing 864 errors, and managing retries.

> - Schedule test windows with each retailer and account for blackout periods/holiday freezes.

Where EDI Integration Providers Fit

For smaller and mid-sized brands, building EDI in-house is expensive and resource-intensive. You’d need software, mappings, VAN or AS2 connectivity, monitoring, and people who can maintain it. Most teams would rather focus on product and fulfillment than on EDI plumbing.

That’s where providers like SPS Commerce, TrueCommerce, and Rithum come in. They operate as EDI-as-a-Service.

SPS Commerce is the largest player. They manage connections for thousands of suppliers and retailers. Instead of building your own stack, you connect to SPS, and they translate your data into the format each retailer requires. Home Depot wants ANSI X12? SPS handles it. A European retailer wants EDIFACT? Also handled.

TrueCommerce and Rithum work similarly. They maintain connections, own the technical complexity, and provide interfaces to manage transactions. In practice, you rent their infrastructure rather than building your own.

Typical costs we see for retail EDI software and services:

- Platform subscription: roughly $300–$1,200/month depending on document volume and number of trading partners.

- Usage: per-document fees in the ~$0.15–$1.00 range (or kilo-character pricing via VANs).

- Onboarding/mapping: $500–$3,000 per retailer for standard maps; custom work often billed at $150–$250/hour.

- Testing/certification: sometimes included; sometimes $250–$750 per trading partner.

Typical timelines:

- 1 retailer: 2–6 weeks from kickoff to production, depending on retailer responsiveness and test cycles.

- 3–5 retailers: 6–10 weeks to stand up the initial stack with staggered go-lives.

Case example (anonymized): Lighting Hub, a 6-person operations team selling lighting components, tried to handle “EDI” via email and spreadsheets while onboarding Zoro and Home Depot. In the first two weeks they logged 23 oversold units and 11 ASN-related chargebacks. We moved them to SPS Commerce, mapped 850/855/856/810, and added GS1-128 label printing at their 3PL. Timeline: 6 weeks to production for both retailers. Cost landed near $700/month plus ~$0.22 per document. Results: ASN chargebacks dropped from 11 in month one to 1 by month three; oversells stopped once inventory sync was tied to EDI acknowledgments. The sticking point was pack-level ASNs—the fix was a scan step to capture carton IDs before label application.

The trade-off: EDI service providers charge platform and per-transaction fees, but the total cost is typically far lower than staffing and maintaining internal EDI. Most brands choose this route unless they have very high volume with a small number of retailers.

Decision: If you have one or two retail partners with stable requirements, a direct connection can be efficient. If you’re expanding across multiple retailers or anticipate change, use a provider.

Common Pitfalls in EDI Implementation

A few patterns show up repeatedly:

- Delaying EDI setup until after the first PO. The scramble leads to chargebacks and missed ship windows.

- Underestimating timelines. Retailer testing cycles and response times make 2–6 weeks per retailer realistic, not one week.

- Thin testing. Teams skip validating 856 pack hierarchies, 810 tax/freight segments, or 997/FA behavior—and discover gaps in production.

- Provider fit mismatches. Choosing a provider without the required doc set, weak WMS/3PL connectors, or a support model that doesn’t match your team’s hours.

Decision: If you optimize for speed to first PO with a small retailer set, use a provider. If you need complex pack flows or custom documents, invest earlier in mapping, labeling, and test coverage.

The Software Layer: EDI Built In

Some commerce platforms treat EDI as a core requirement and include it natively, reducing the integration surface area for operators. This is one way to consolidate retail EDI software with your day-to-day order flow.

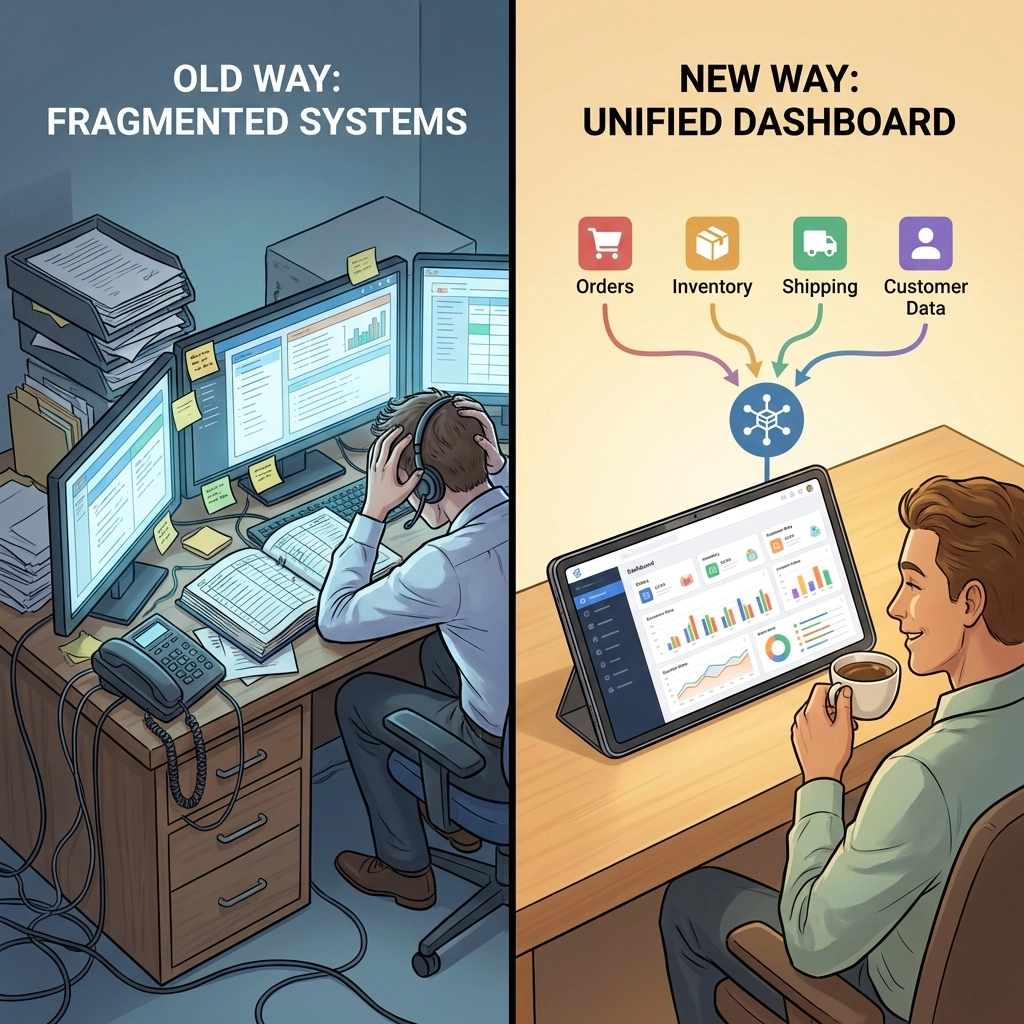

Acenda is a good example. Their platform includes built-in EDI, so teams can manage DTC orders and retail EDI flows from the same dashboard. A Home Depot PO arriving via EDI appears alongside Shopify orders.

GoFlow takes a similar approach as an order management system. EDI is integrated so orders from retailers (EDI) and marketplaces (APIs) run through a unified workflow.

This approach solves a familiar problem. We’ve seen teams running eCommerce in one system and retail EDI in another end up with mismatched inventory, duplicate work, and avoidable errors.

When to use embedded/native EDI (Acenda, GoFlow):

- 1–5 retailers with standard doc sets (850/855/856/810) and few edge cases.

- Centralized OMS/WMS and straightforward pack/ship processes.

- Priority is fewer systems and a single operational workflow.

When to use a standalone EDI provider alongside your stack:

- >5 retailers, varied requirements, or advanced pack hierarchies and cross-dock flows.

- Need for dedicated mapping tools, monitoring, and broader retailer libraries.

- Priority is flexibility and scale over consolidation.

Decision: If you’re already on or evaluating these platforms, native EDI can simplify operations. If your current stack is stable but your retailer mix is expanding, a standalone provider is usually the cleaner path.

Why EDI Isn’t Going Anywhere

It’s reasonable to ask why retailers haven’t shifted wholesale to newer interfaces. The short answer: EDI does its job well.

APIs handle real-time interactions and complex queries. EDI is built for standardized, high-volume transactions. It’s reliable, predictable, and efficient at batch processing. For retailers running millions of transactions, those traits outweigh real-time responsiveness.

> Reality: EDI has been around since the 1970s because it solves a durable problem: automated, standardized exchange of business documents.

Compliance momentum is real. EDI is embedded in supplier agreements, internal systems, and day-to-day processes. Replacing it would require coordinated, multi-party change with limited upside for operators already meeting SLAs.

For emerging brands, EDI capability is not optional if retail is part of the plan. The decision is which path you take: build, buy, or rent via a provider.

If this is relevant to your situation, we’re happy to talk through requirements, timelines, and provider fit. Book a short consultation on our services page.

Next in this series: Multi-channel expansion technical barriers—catalog normalization, inventory sync, and returns routing.