Home Depot vs. Lowe's: Which Platform Fits Your Business? (Part 1 of 3)

Choosing between Home Depot and Lowe's isn't about which generates more revenue: it's about which operational reality fits your business. Most brands fail because they chase the bigger opportunity instead of matching their capabilities to platform requirements.

The fundamental difference: Home Depot operates through active merchant relationship building. Lowe's functions as a passive database where you apply and wait unless you have direct merchant connections.

The Onboarding Reality Nobody Explains

Key Takeaway: Portal applications create vendor files. Merchant sponsorship creates movement. Without direct buyer relationships, submissions at both retailers often sit indefinitely regardless of product quality.

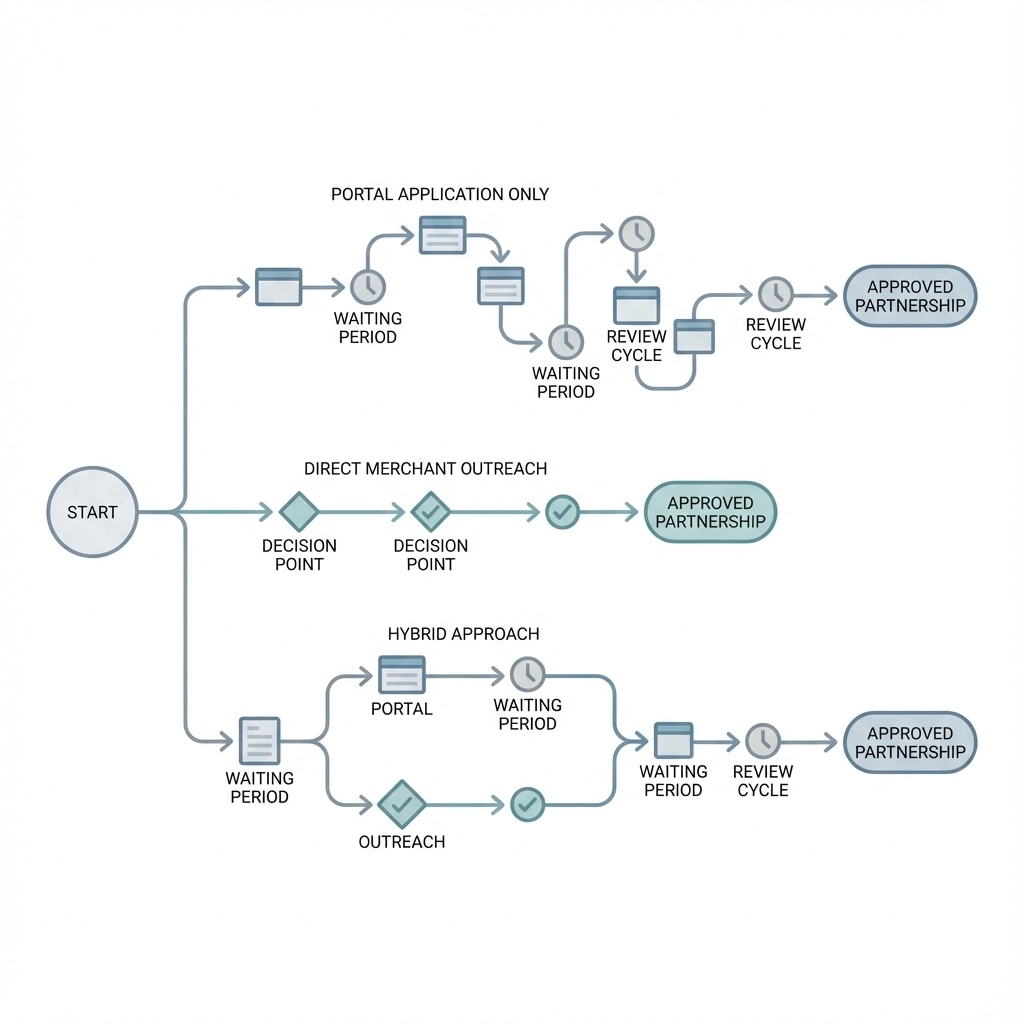

Both retailers maintain formal intake portals. Home Depot uses the Supplier Hub; Lowe's uses the Prospective Supplier Database. These are necessary for creating records and clearing compliance, and for unknown brands the database/application path is the standard starting point.

But here's what actually moves an opportunity at both retailers: merchant buy-in.

When a category merchant (or their DMM/VP) sponsors your line review, vendor setup and testing get scheduled. Without a sponsor, submissions can sit for months. Experienced partners like Ecom Diversify typically bypass the generic inboxes by pitching directly to merchant teams at Home Depot and Lowe's, then backfill the portal steps once there's interest.

Home Depot: Submit via Supplier Hub to open a file. Once a merchant engages, vendor numbers are issued and Commerce Desktop/EDI testing is scheduled. The published timeline is 6-10 weeks from application to production, but that depends entirely on merchant sponsorship. Unsponsored submissions receive routine updates but no movement.

Lowe's: Add your line to the Prospective Supplier Database; the record doesn't expire, but the database itself doesn't create urgency. A merchant sponsor triggers the actual review and vendor setup. Lowe's marketplace can be used to validate demand while you build the merchant case: Home Depot doesn't offer this option.

Real example: Lighting Hub, one of our first clients, sat in exploratory conversations with Lowe's buyers for months before a category merchant took interest. Once sponsored, they moved through vendor onboarding in under six months. At Home Depot, they spent a year building merchant relationships. In year two, they were invited to Home Depot headquarters in Atlanta for a line expansion review: a direct result of consistent performance and merchant advocacy, not portal applications.

The time cost: Brands relying solely on database submissions average 8-14 months before first merchant contact at Lowe's, if they receive one at all. During that time, competitors with merchant relationships are already shipping product, building buyer trust, and learning category dynamics.

Understanding Your Customer: Contractors vs. Homeowners

Key Takeaway: Home Depot customers are project-driven contractors making bulk efficiency purchases. Lowe's customers are design-focused homeowners planning room aesthetics. Same product category, completely different buying psychology: which drives different content, pricing, and inventory strategies.

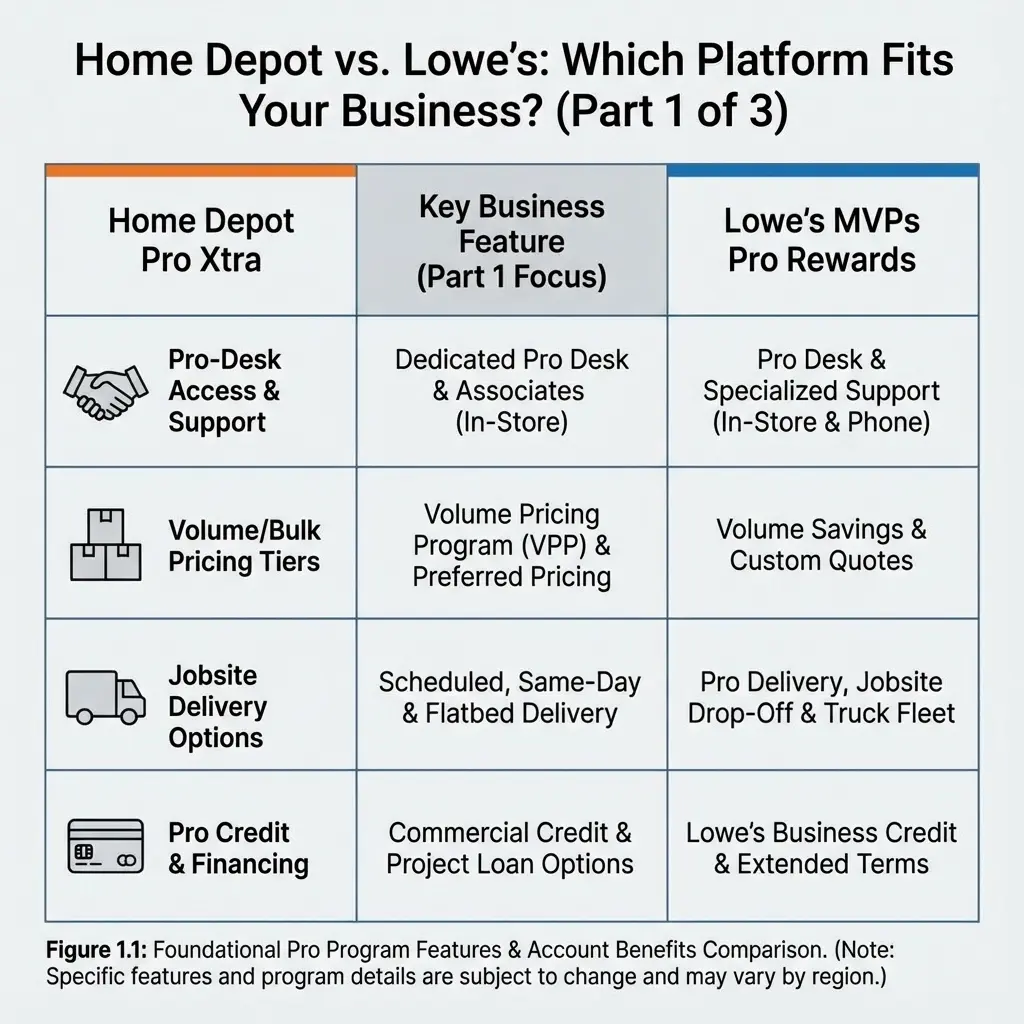

Home Depot customers skew heavily toward contractors and professional builders. Their Pro Xtra program offers tier-based volume discounts with dedicated outside sales teams. Product focus centers on building materials, structural components, and professional-grade tools. Exclusive brands include Behr paint, Ryobi/Milwaukee tools, Husky, and Ridgid.

Shopping behavior follows project cycles: bulk purchasing, repeat professional buyers, efficiency-focused decisions. A contractor buying 50 boxes of tile isn't browsing lifestyle photography: they're verifying square footage coverage, checking mortar compatibility, and calculating jobsite delivery timing. Home Depot ranks #4 in North American ecommerce sales, driven primarily by Pro customers ordering materials for active jobsites.

What this means for you: Home Depot product listings need technical specifications, installation requirements, compatibility data, and project application details. A lighting product that works on Amazon with "modern design" needs to pivot to "5000 lumens, 4000K color temperature, 50,000-hour commercial-grade lifespan, linkable up to 4 units, suitable for warehouse/garage/workshop applications."

Lowe's balances DIYers with professional customers. Their MyLowe's Pro Rewards uses a 3-tier system based on annual spending, with unlimited military discounts (Home Depot caps at $400 annually). Product focus emphasizes appliances, design-forward selections, plants/garden, and broader aesthetic appeal.

The customer shops differently: design-focused, home aesthetics, project inspiration rather than pure efficiency. A homeowner buying tile is looking at room visualization, color matching with existing décor, and "how difficult is this to install myself?" Lowe's ranks #11 in North American ecommerce but offers stronger appliance selection and design positioning.

What this means for you: Lowe's listings benefit from lifestyle photography, room settings, design inspiration, and DIY installation guidance. The same lighting product pivots to "transform your dining room with warm ambient lighting, includes easy-install instructions for weekend projects, pairs beautifully with modern farmhouse décor."

This customer difference drives everything else: content strategy, photography requirements, seasonal inventory patterns, even payment cycle expectations.

The $8 Million Insurance Barrier

Key Takeaway: Home Depot requires $8 million in liability insurance: a single requirement that eliminates most brands before they submit applications. Lowe's requires standard retail insurance without the same strict threshold. This alone might make your platform decision for you.

Home Depot requires $8 million liability insurance. This single requirement eliminates most smaller brands before they even submit applications.

Why this matters: Standard business liability policies for small manufacturers typically cover $1-2 million. Upgrading to $8 million requires specialized commercial coverage that costs significantly more: often 3-5x the premium of standard policies. For a brand doing $500K-1M annually, this insurance requirement alone can add $8,000-15,000 in annual overhead before shipping a single unit.

Real example: When Lighting Hub applied to Home Depot, the $8 million insurance requirement was their biggest obstacle. Their existing policy covered $2 million. We connected them with a specialty insurance broker who works with industrial suppliers and understands big-box retail requirements. They secured $8.5 million coverage at roughly 40% less than their initial quote from a general business insurance provider. Without that connection, the cost would have made their Home Depot expansion unprofitable for the first 18 months.

Lowe's requires standard retail insurance but doesn't enforce the same strict dollar thresholds publicly. Most brands can meet Lowe's insurance requirements with their existing commercial policies or modest upgrades. This creates a real access difference: Lowe's is operationally available to brands that Home Depot's insurance barrier eliminates entirely.

Beyond insurance, the platforms differ operationally:

Home Depot's lumpy demand patterns from large contractor purchases create inventory challenges. A single commercial contractor might order 200 units for a hotel renovation project, then nothing for two months. You need predictive inventory planning that accounts for project-based buying cycles, not steady consumer demand. Their algorithm punishes stockouts harshly: run out during busy season and your search visibility drops.

Lowe's experiences seasonal demand spikes during spring and fall home improvement seasons. Homeowners plan projects around weather: deck staining in spring, weatherproofing in fall, holiday decorating in November/December. Your inventory planning needs 40-60% higher stock levels in peak seasons compared to winter/summer lulls.

The Marketplace Advantage (Lowe's Only)

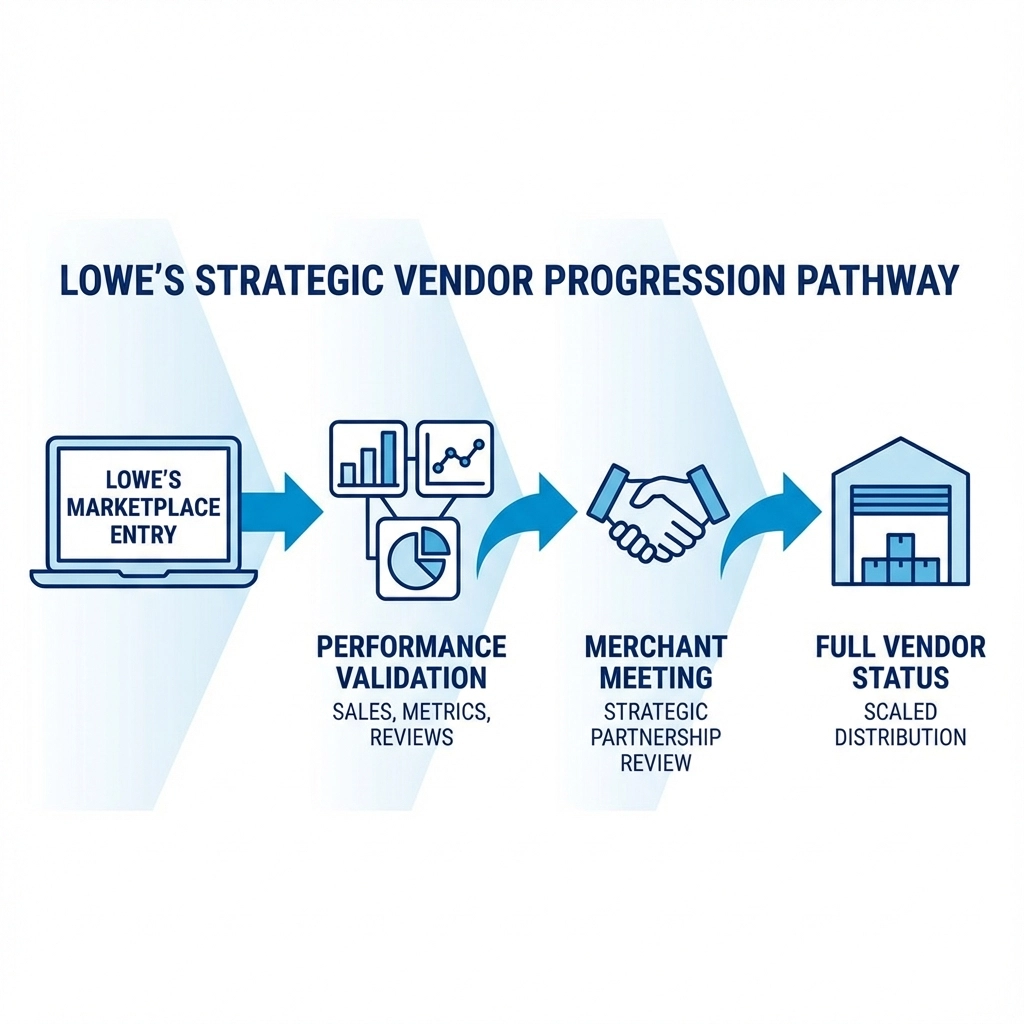

Key Takeaway: Lowe's offers a third-party marketplace that lets you test products before committing to full vendor operations. Home Depot has no equivalent path. For unknown brands, this is Lowe's biggest strategic advantage.

Lowe's launched a third-party seller marketplace in 2021, allowing brands to list and sell products on Lowes.com without going through the full wholesale vendor process. You control pricing, hold your own inventory, fulfill orders yourself, and pay Lowe's a commission on sales.

Why this matters strategically: The marketplace provides a backdoor entry that Home Depot doesn't offer. Brands can:

- Test product-market fit with Lowe's customers before committing to full vendor operations

- Validate pricing and positioning with real sales data

- Demonstrate category demand to Lowe's merchants using actual performance metrics

- Build customer reviews and brand awareness within the Lowe's ecosystem

- Avoid EDI requirements, insurance barriers, and complex vendor onboarding initially

The real pathway: Launch on Lowe's marketplace → generate 6-12 months of sales data → use that performance to pitch category merchants for full vendor consideration → transition successful SKUs to wholesale while keeping slower movers marketplace-only.

This option simply doesn't exist at Home Depot. You're either a full vendor or you're not.

Decision Framework: Which Platform Fits You?

Key Takeaway: Choose based on what you can execute operationally, not what generates the biggest revenue opportunity. The wrong platform choice creates operational debt that compounds monthly.

Choose Home Depot if:

- Your products serve contractors, professional builders, or B2B accounts primarily

- You have technical or installation-heavy products where specifications drive purchase decisions

- Your brand can meet the $8 million insurance requirement (or secure it cost-effectively)

- You have merchant relationships or strong pitch capabilities to access buyers directly

- Your products emphasize durability, professional-grade quality, project efficiency

- Your margins support higher operational overhead and $2,500+ bulk pricing minimums

Choose Lowe's if:

- Your products appeal to DIYers and homeowners with professional use as secondary

- You have design-forward, aesthetics-focused products where visual appeal drives decisions

- You want marketplace testing before committing to full vendor operational requirements

- Your products align with seasonal home improvement cycles (spring/fall project planning)

- You prefer lower bulk purchase minimums ($1,500 vs. $2,500)

- Your brand can meet standard retail insurance without the $8M barrier

Choose Both if:

- You have product lines serving both contractor and DIY markets with clear differentiation

- You can support two different content strategies simultaneously

- You have operational capacity for dual-platform management

- You want maximum market coverage and can manage platform-specific requirements

- Your margin structure supports the overhead of dual-platform operations

Real example: Our industrial clients who expanded from Amazon-only to $8M+ across retail channels successfully navigated both Home Depot and Lowe's by understanding that the platforms require different operational approaches and building platform-specific strategies that matched each retailer's customer psychology.

The decision isn't which platform offers more opportunity: it's which operational requirements match your current capabilities.

Ready to Make the Right Platform Decision?

Not sure which platform fits your operational capabilities? We work with brands doing $500K+ annually who are serious about retail expansion. If that's you, we'll evaluate your product line, assess your operational readiness, and tell you honestly whether Home Depot, Lowe's, both, or neither makes sense right now.

If your products fit, we'll pitch them to the merchant teams we've worked with for years. If they don't fit, we'll tell you that too: and save you 6-12 months of wasted effort applying through database portals that go nowhere.

We pitch 3-4 brands per quarter to Home Depot and Lowe's buyers. Our approval rate is over 90% because we only pitch brands we know can execute operationally and that fill genuine category needs buyers have expressed to us directly.

Coming Next Week: Part 2 reveals the EDI complexity, compliance penalties, and content requirements that break most vendor relationships before they generate meaningful revenue.