Home Depot vs. Lowe's, Part 2: The Hidden Operational Barriers That Break Most Vendors

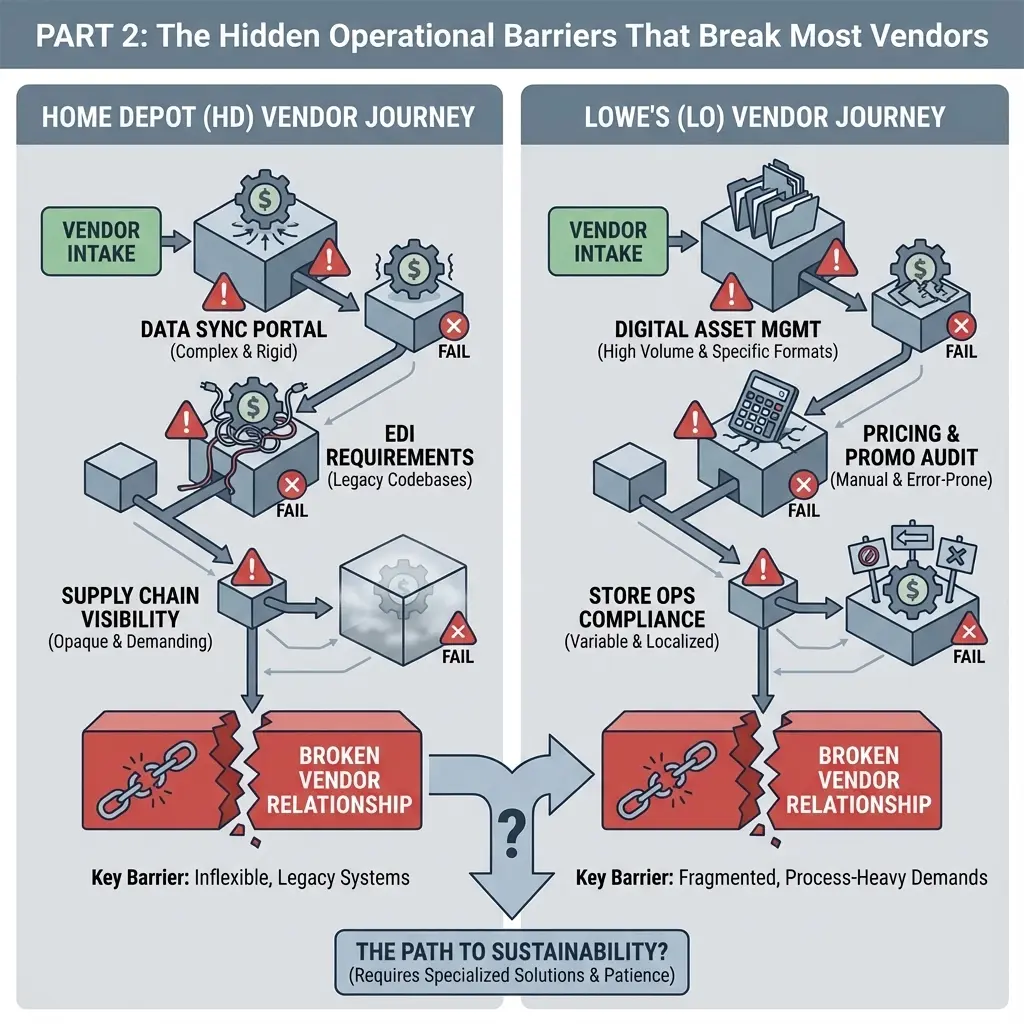

In Part 1, we covered the strategic decision: which platform matches your business model and customer base. Now we're diving into the operational reality that most brands catastrophically underestimate.

Portal applications are easy. Actually operating on these platforms is where 60% of approved vendors fail within the first 12 months: not because their products don't sell, but because they can't maintain operational compliance.

Here's what breaks most vendor relationships before they generate meaningful revenue.

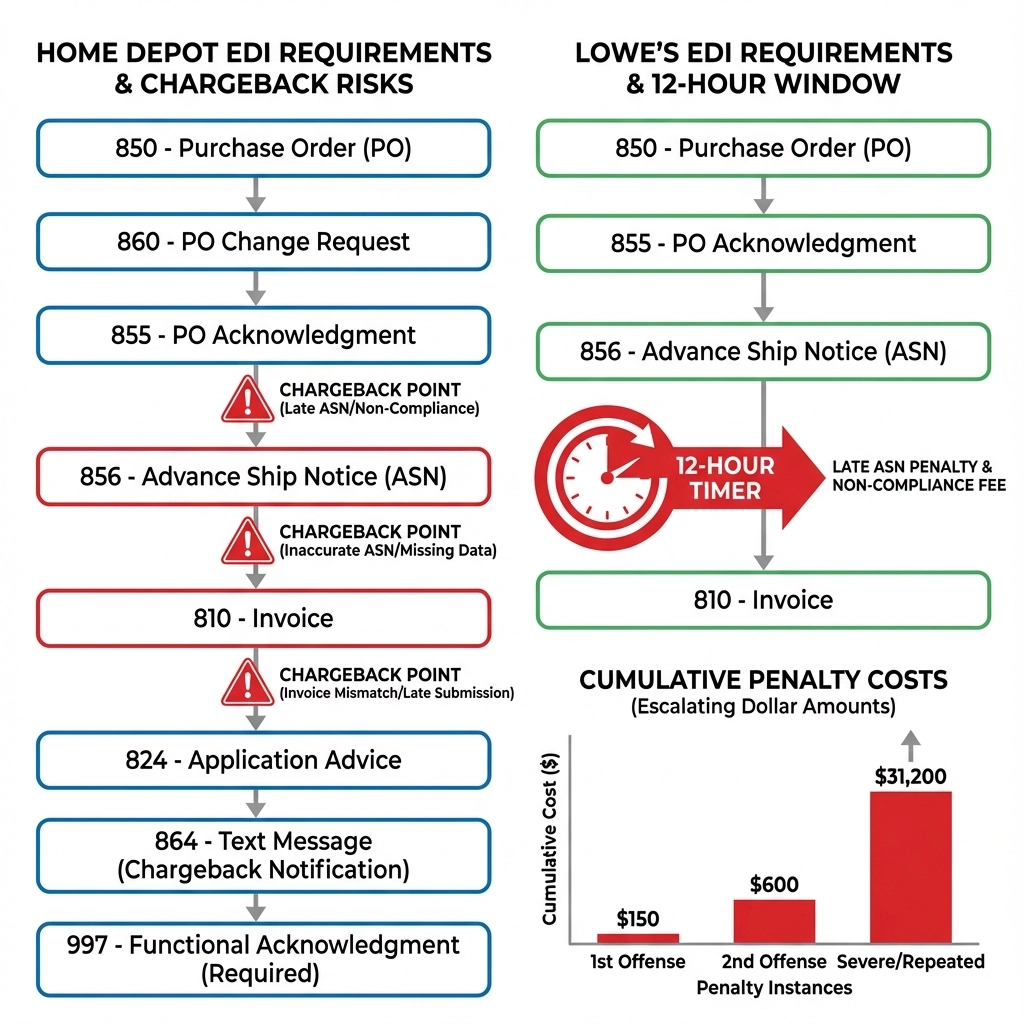

EDI Complexity: The $31,000 Annual Mistake

> Key Decision: EDI isn't just "technical stuff your IT person handles." It's a system of automated transactions where one wrong shipment ID triggers a $150 chargeback with no dispute process. Ship 40 orders/week with a 10% error rate and you're hemorrhaging $31,200 annually in avoidable penalties.

Most brands think EDI (Electronic Data Interchange) is something you "set up once and forget." That's the thinking that costs them thousands monthly in automated chargebacks.

Home Depot requires eight specific EDI documents: 850 (Purchase Order), 856 (Advance Ship Notice), 810 (Invoice), 820 (Remittance Advice), 997 (Functional Acknowledgment), 832 (Price/Sales Catalog), 846 (Inventory Advice), and 864 (Text Message for errors). Each document represents an integration point where data errors trigger automated penalties.

The 856 (Advance Ship Notice) isn't just a tracking update: it's what Home Depot's distribution centers use to prepare receiving docks, allocate labor, and schedule inbound processing. Submit it late, with incorrect carton counts, or without proper shipment IDs pulled from their TMS portal, and you trigger chargebacks averaging $150 per incident.

The math on this is brutal. Ship 40 orders per week with a 10% ASN error rate: 4 violations/week × $150 = $600/week. That's $31,200 annually in avoidable penalties.

These aren't negotiable. Home Depot's automated chargeback system has minimal dispute process. Once triggered, the penalty hits your account and reduces your effective margin before you even realize what happened.

Lowe's takes a different approach but isn't more forgiving: just differently strict. They support more transmission protocols (VAN, AS2, FTP, HTTPS), giving smaller vendors flexibility. Their LowesLink Webforms work for vendors processing fewer than 100 purchase orders or invoices annually: a legitimate low-volume onramp that Home Depot doesn't offer.

But Lowe's enforces the 855 Purchase Order Acknowledgment within 12 hours of receiving the 850 Purchase Order. Miss this window and you're penalized before the product even ships.

One client came to us averaging 15% late acknowledgments due to weekends, holidays, and system downtime: 60 POs/week × 15% = 9 violations/week. That's 117 penalties per quarter at $75-100 each, or $8,775-11,700 in quarterly chargebacks: 3-4% margin erosion before a single unit ships.

Your decision: Run manual EDI monitoring and accept ongoing chargeback risk, or invest in proper automation upfront. You gain speed and compliance with automation, but accept $4,500-8,000 in integration costs and 8 weeks of system work.

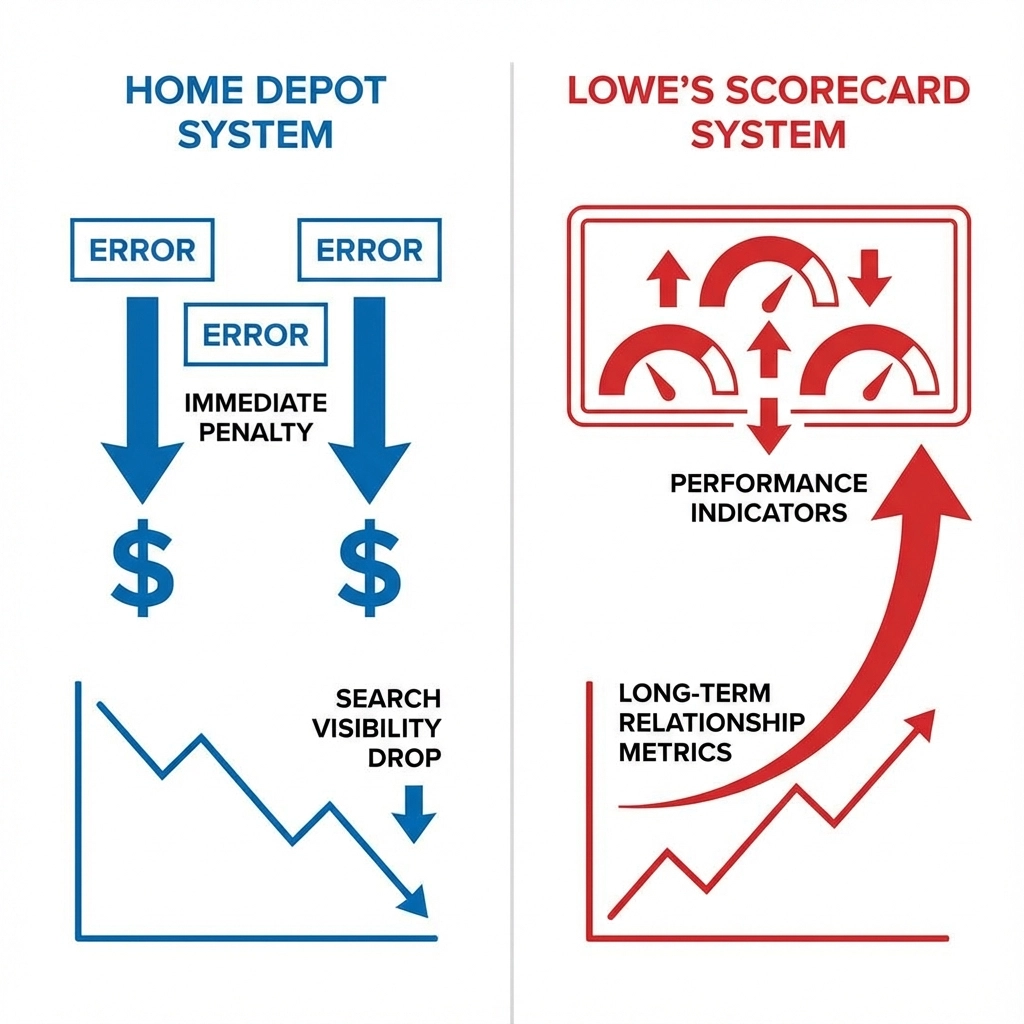

Performance Tracking: Two Different Punishment Systems

Key Decision: Home Depot hits you with immediate automated chargebacks: wrong data costs you money today. Lowe's uses scorecards that affect long-term buyer relationships and category expansion opportunities. Both are unforgiving, just in different ways that require different monitoring strategies.

Home Depot operates a binary system: Error → Automatic Chargeback → No Dispute. Common violations include late or missing ASN, incorrect shipment IDs, carton labeling errors, and mismatched PO data.

Performance metrics directly affect account standing and search visibility within their platform. Poor compliance scores reduce product visibility in search results, creating a downward spiral: your products get buried on page 3-4 of search results → sales decline → you lose "fast mover" status → buyers question your operational capabilities.

We watched one vendor go from page 1 visibility to page 4 after compliance issues during Q4 holiday season. Their sales dropped 40% week-over-week, not because demand changed, but because Home Depot's algorithm deprioritized their listings. It took three months of perfect compliance to rebuild algorithmic trust.

Lowe's uses scorecard-based performance tracking through their Vendor Portal dashboard with real-time updates. They monitor 855 acknowledgment timing, shipment schedules, data format accuracy, and duplicate transaction errors.

Unlike Home Depot's immediate financial penalties, Lowe's scorecards affect long-term relationship quality: buyer willingness to expand your SKU count, category team confidence in your operational capabilities, and priority during promotional planning.

Your decision: Optimize for Home Depot's immediate compliance to prevent financial bleeding, or focus on Lowe's long-term scorecard metrics for relationship building. You can't optimize for both simultaneously without dedicated resources.

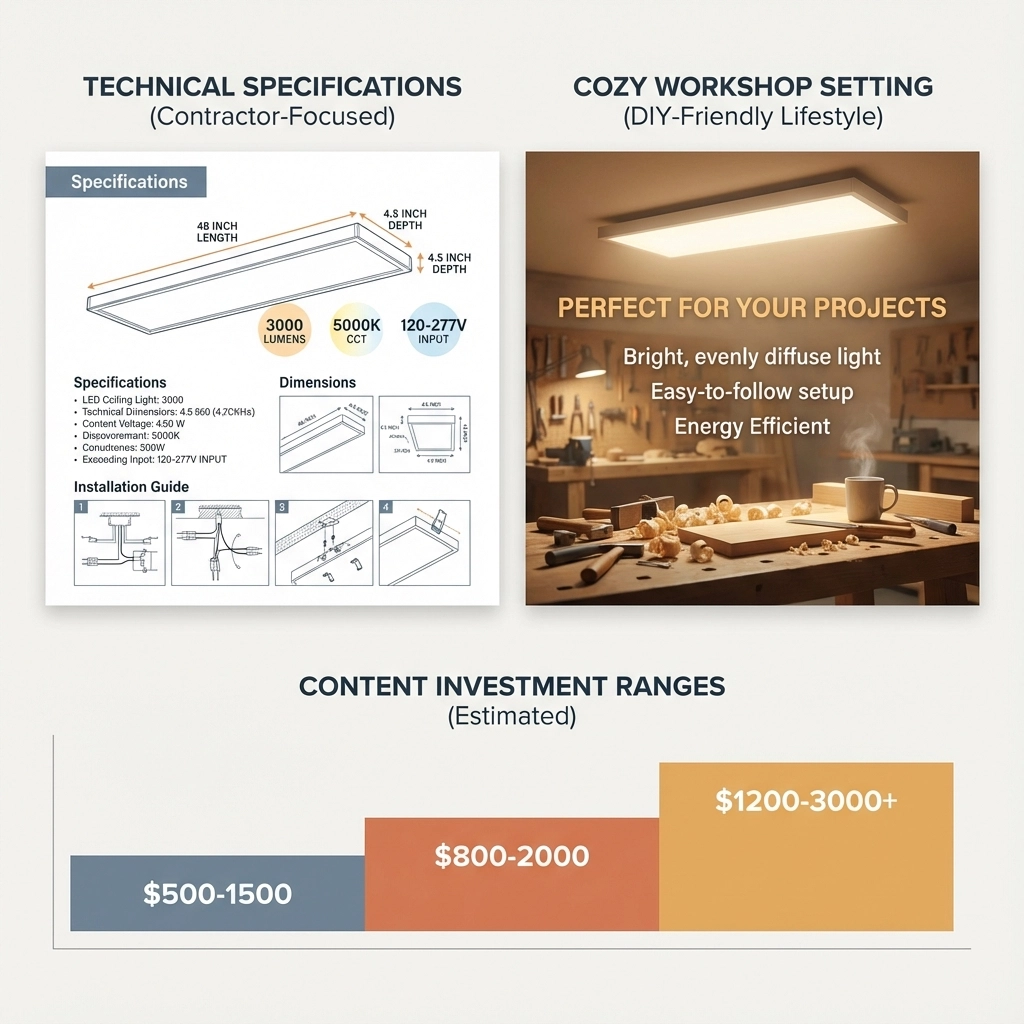

Content Requirements: Same Products, Completely Different Stories

Key Decision: Identical listings across both platforms guarantee you're optimizing for neither. The content investment is real: budget $25,000-60,000 for professional photography, copywriting, and catalog development for a 20-SKU line across both channels.

Content requirements reflect the fundamental customer differences we covered in Part 1. But most brands underestimate the actual investment required.

Home Depot demands technical specifications, installation information, professional-grade documentation, and photography showing contractor environments. An LED shop light on Amazon might say "Bright white light, energy efficient, modern design."

For Home Depot: "5000 lumens, 4000K color temperature, 50,000-hour commercial-grade lifespan, linkable up to 4 units, suitable for warehouse/garage/workshop applications, replaces 4-lamp T8 fluorescent fixtures, complies with Title 24 energy codes."

Lowe's requires DIY-focused positioning, how-to content, installation support resources, and lifestyle imagery. The same LED shop light for Lowe's: "Brighten your garage workshop or hobby space with clean, natural light. Easy weekend installation with included mounting hardware and clear instructions. Perfect for workbenches, craft rooms, or utility areas."

For a 20-SKU product line launching on both platforms, total content investment runs $25,000-60,000. Professional product photography costs $500-1,500 per SKU. Lifestyle photography with room settings runs $800-2,000 per setup. Technical documentation requires $300-800 per product. Platform-specific copywriting costs $200-400 per SKU.

Cut corners here and your conversion rates suffer by 30-50% compared to properly optimized competitors. On a $500,000 annual revenue target, that's $175,000-225,000 in additional sales from the same traffic: purely from better content matching customer intent.

Your decision: Invest in dual-content strategies to maximize platform-specific conversion, or use generic content and accept 30-50% lower conversion rates.

Inventory Planning: Project Cycles vs. Seasonal Surges

> Key Decision: Amazon's steady consumer demand doesn't prepare you for Home Depot's lumpy contractor orders or Lowe's seasonal project cycles. Traditional safety stock calculations fail completely. You need predictive inventory planning that accounts for platform-specific buying patterns.

Home Depot's challenge is lumpy, project-based demand. A single commercial contractor orders 200 units for a hotel renovation project, then nothing for two months. Traditional inventory planning uses average weekly sales to calculate reorder points: this approach fails catastrophically with Home Depot's demand patterns.

You calculate safety stock based on "average 30 units/week." A contractor project order for 200 units hits. You're out of stock for 3 weeks waiting for production. Home Depot's algorithm punishes the stockout. Your search visibility drops.

You need 40-60% higher safety stock for Home Depot SKUs compared to consumer-facing channels, specifically allocated for large project orders.

Lowe's challenge is seasonal home improvement cycles. Homeowners plan projects around weather: spring deck staining and landscaping, fall weatherproofing and winterization, November-December holiday decorating. Your inventory planning needs 40-60% higher stock levels in peak seasons compared to off-season lulls.

One outdoor lighting vendor underestimated Lowe's spring demand surge. They stocked based on Q1 winter sales. April orders spiked 3x their inventory capacity. They stockout for 3 weeks during peak season, missing $85,000 in revenue. The following year, they front-loaded inventory in February. Result: $340,000 Q2 revenue vs. $175,000 the previous year.

Your decision: Maintain higher safety stock and accept increased carrying costs, or risk stockouts during peak demand periods that damage algorithmic visibility and buyer relationships.

Payment Terms: The Cash Flow Reality

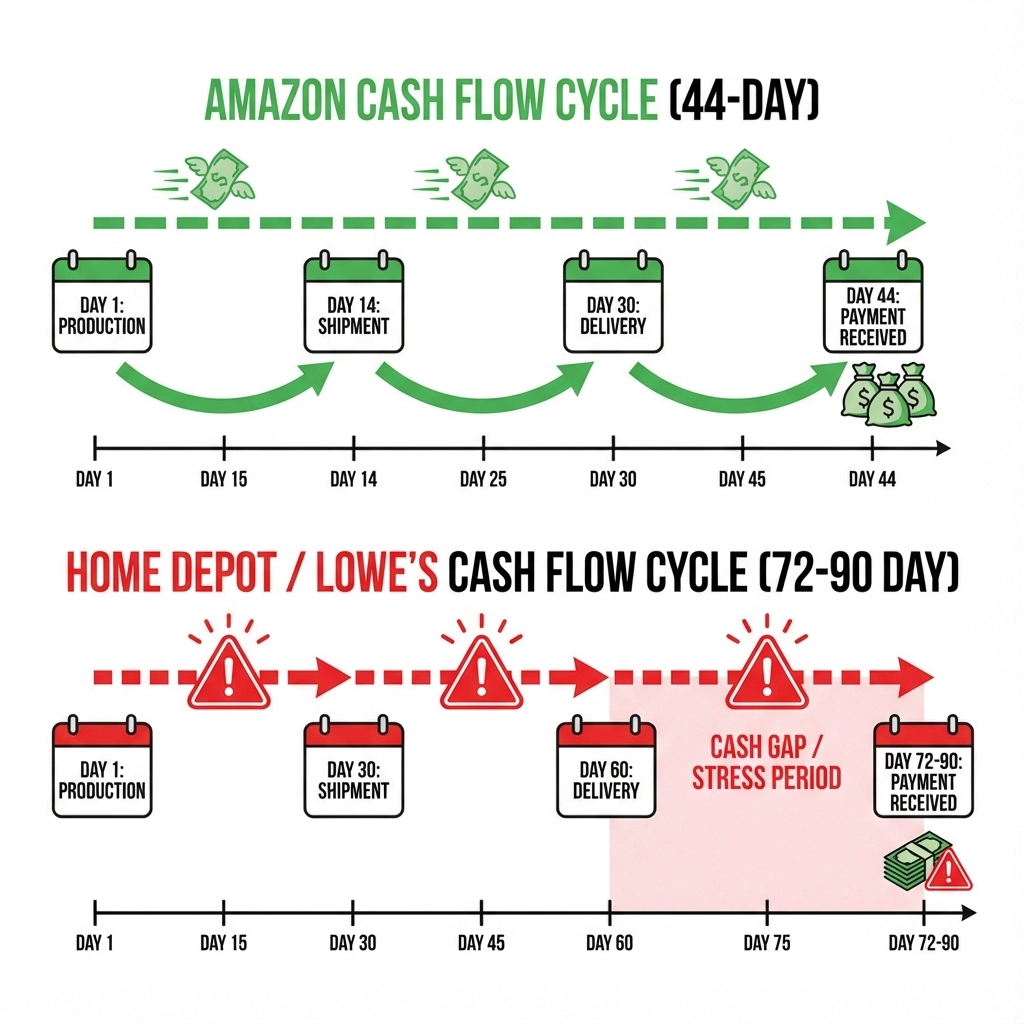

Key Decision: Amazon pays in 14 days. Home Depot and Lowe's run 30-60 day payment cycles with invoice/receipt requirements. This cash flow gap kills undercapitalized brands even when products sell well. Budget for 60-90 days of working capital before first payment arrives.

Most Amazon sellers are accustomed to 14-day payment cycles. Big-box retail doesn't work that way.

Lowe's payment terms begin on satisfactory receipt of products OR correct invoice submission, whichever comes later. You ship on Day 1. Product arrives at DC on Day 5. Receiving inspection completes Day 8. Invoice processing begins Day 10. Net-30 payment terms mean Day 40 payment. Actual payment arrives Day 42-45.

If there are ANY invoice discrepancies, payment delays another 15-30 days while issues resolve.

The working capital trap: You produce inventory Day -30, ship to retailers Day 0, receive payment Day 42-60. Total cash cycle: 72-90 days from production to payment. Compared to Amazon's 44-day cycle, you're carrying 28-46 additional days of cash float.

For a brand doing $500K annually through retail, average monthly inventory investment runs $35,000-45,000. Extended payment terms add 30-45 days working capital requirement: an additional $35,000-68,000 compared to Amazon operations.

Undercapitalized brands run out of cash to produce the next inventory cycle before receiving payment from the current cycle. Products sell well, but the business fails due to cash flow timing.

Your decision: If you're bootstrapped or operating on thin working capital, factor extended payment terms into your platform decision: not just revenue opportunity, but whether your balance sheet can support 60-90 day payment cycles.

What's Coming in Part 3

This post covered the operational barriers that break most vendor relationships: EDI complexity, performance tracking systems, content requirements, inventory planning, and payment timing.

Part 3 will break down exactly what this costs: first-year investment breakdown of $45,000-85,000 for proper execution, where brands cut corners and pay later, ROI calculation and realistic payback timelines, and real client cost examples with actual numbers.

Most brands discover these complexities after they're approved and scrambling to get operational. By then, you're burning cash on chargebacks, fighting compliance issues, and damaging buyer relationships that take years to rebuild.

We've guided 100+ brands through Home Depot and Lowe's onboarding. We know which EDI providers actually work, which insurance brokers understand retail requirements, and how to avoid the cash flow traps that kill undercapitalized operations.

If you're doing $500K+ annually and want to avoid the $30,000+ in preventable mistakes most brands make during their first year, before you commit to either platform: