Home Depot vs. Lowe's Part 3: What It Actually Costs to Launch on .com (And Why Most Brands Underbudget by 60%)

In Part 1, we covered the strategic platform decision. Part 2 revealed the operational barriers that break most vendors. Now we're talking about money: the actual dollars required to launch properly on HomeDepot.com and Lowes.com.

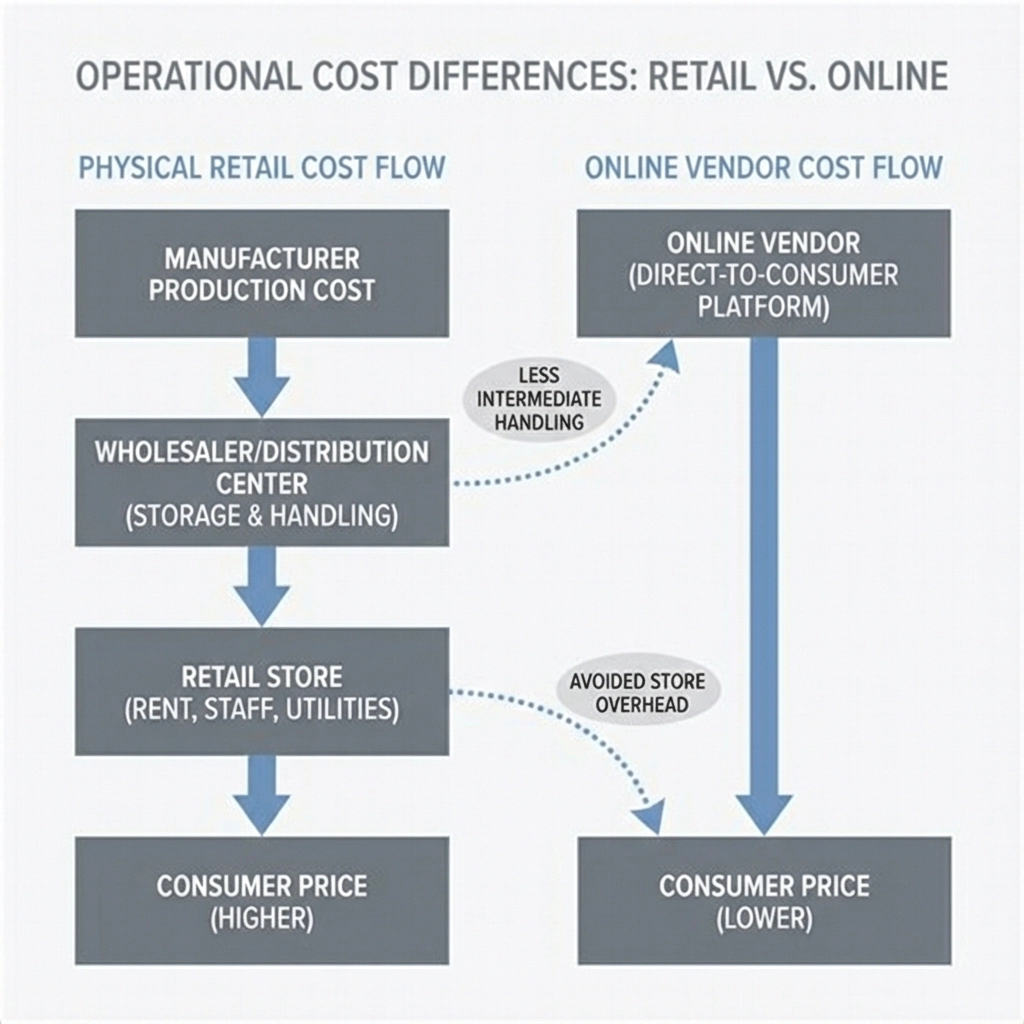

Important clarification: This guide focuses on online-only vendor relationships: selling through HomeDepot.com and Lowes.com without physical store placement or distribution center fulfillment. This is the most common entry path for Amazon sellers expanding into retail, with significantly different cost structures than brick-and-mortar programs.

Portal applications are free. Operating on these platforms costs $35,000-65,000 in first-year setup for a 20-SKU line when done correctly. Cut corners and you'll pay 2-3x that amount through chargebacks, lost sales, and operational chaos.

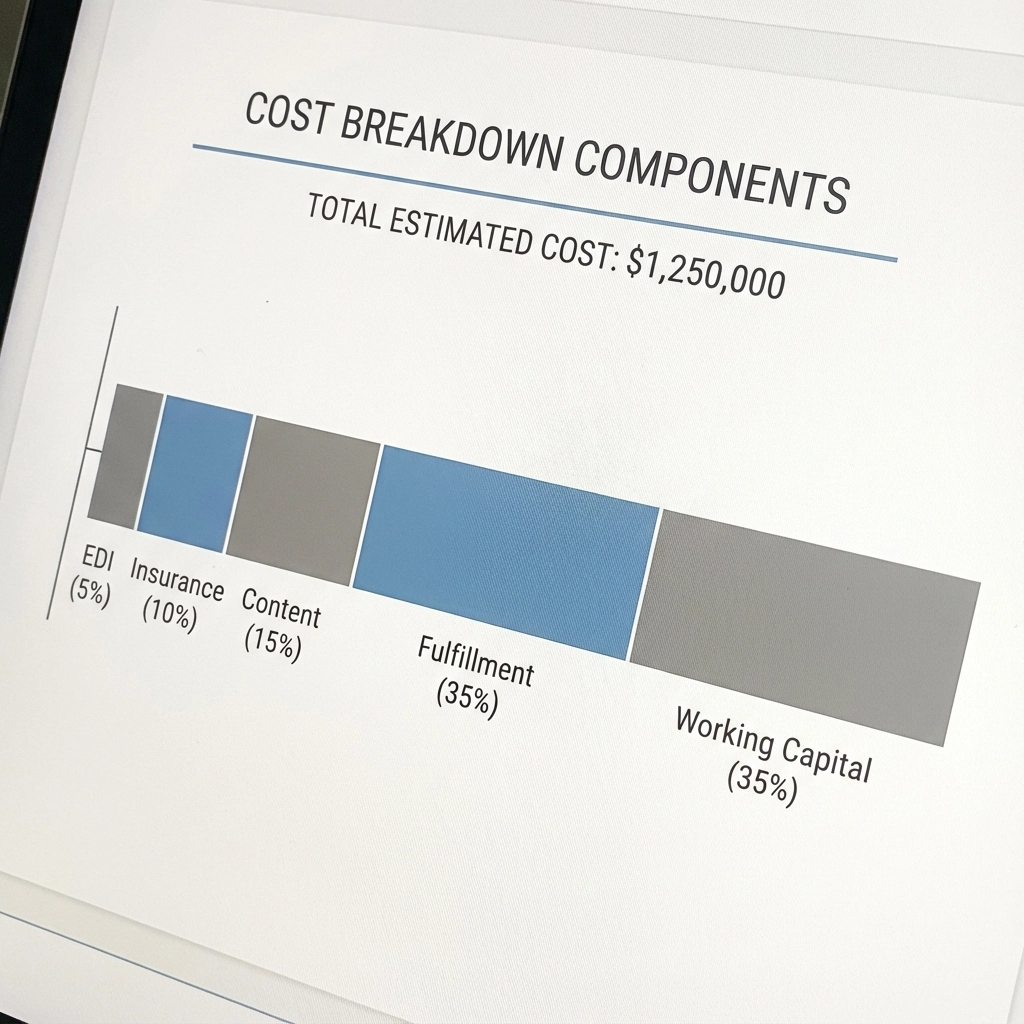

The First-Year Investment Breakdown (20-SKU Product Line, Online-Only)

Key Takeaway: Online-only vendor programs have lower barriers than ship-to-DC programs, but still require EDI compliance, platform-specific content, and working capital for extended payment cycles. Most brands budget for "some setup costs" when the actual investment is $35,000-65,000 for proper execution.

EDI Integration & Software (Simplified for .com)

EDI platform subscription: $300-800/month ($3,600-9,600 annually)

- Online vendor programs typically require fewer EDI documents than DC programs

- Core documents: 850 (PO), 856 (ASN), 810 (Invoice), 997 (Acknowledgment)

- Many vendors can use web portals instead of full EDI for lower volume

Initial setup and mapping: $1,500-3,500 one-time

Shipping integration: $1,000-2,500

Category Subtotal: $6,100-15,600 first year

Key difference from DC programs: You're shipping direct to consumers from your warehouse, not to Home Depot/Lowe's distribution centers. This eliminates GS1-128 carton labeling requirements, TMS portal integration, and pallet labeling complexity.

Insurance Requirements (Lower for Online-Only)

Home Depot .com: $2,000-5,000 annual premium increase

- Online vendor programs typically don't require the full $8M liability

- Standard $2-3M commercial liability usually sufficient

- Significantly lower barrier than physical retail programs

Lowe's .com: $1,500-3,500 annual premium increase

Category Subtotal: $1,500-5,000 annually

Content Development (Platform-Specific Optimization)

Professional product photography: $400-1,200 per SKU (20 SKUs = $8,000-24,000)

Lifestyle/application photography: $600-1,500 per setup (Lowe's emphasis = $2,400-9,000)

Technical content and A+ pages: $200-500 per SKU ($4,000-10,000)

Video content: $500-2,000 per video ($1,500-10,000)

Category Subtotal: $15,900-53,000 one-time

Platform-specific content (not just Amazon copy-paste) improves conversion by 30-40% on average. On a $500,000 revenue target, that's $175,000-225,000 in additional sales from better content matching customer intent.

Working Capital for Extended Payment Cycles

Amazon payment cycle: 30 days production + 14 days payment = 44 days

Home Depot/Lowe's .com payment cycle: 30 days production + 30-45 days payment = 60-75 days

For a brand targeting $500K annually through retail .com:

- Monthly inventory investment: $30,000-40,000

- Extended payment terms: 16-31 additional days

- Additional working capital needed: $16,000-40,000

Cost Comparison: .com vs. Physical Retail

Ongoing Cost Comparison:

- Per-order shipping: Physical retail absorbed by retailer / Online vendor $8-12 per order (you pay)

- Returns processing: Retailer handles / $8-15 per return (you pay)

- Customer service: Minimal / Moderate (you handle)

Total cost of ownership converges: but the risk profile is different:

- Physical retail: Higher upfront barrier, lower ongoing variable costs

- Online vendor: Lower upfront barrier, higher per-transaction costs

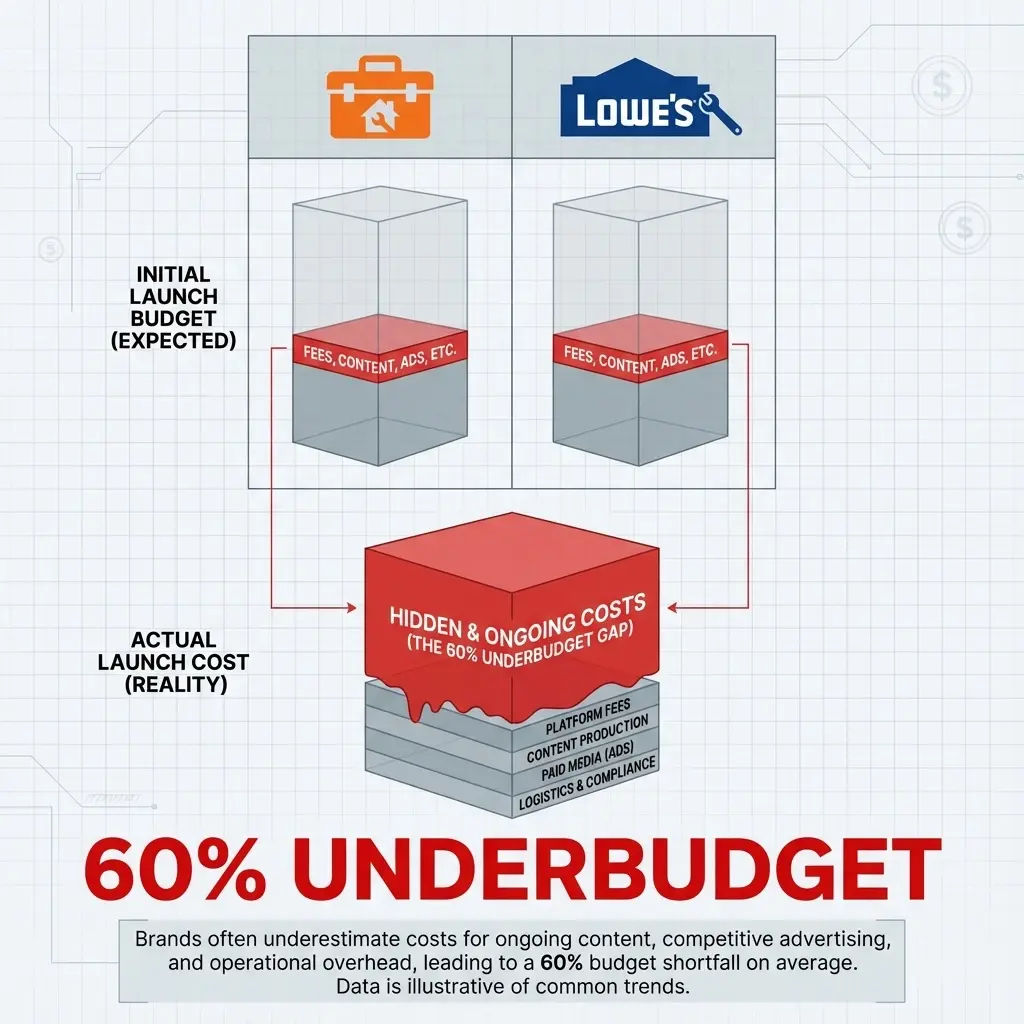

What Happens When Brands Underbudget

> Key Takeaway: Trying to launch on $15,000 when you need $35,000-50,000 creates a specific pattern: manual order processing that can't scale, generic content that converts poorly, shipping cost overruns, and cash flow crises during peak seasons.

The typical underbudgeted .com launch:

- Budget allocated: $10,000-20,000

- Actual requirements: $35,000-50,000 (excluding working capital)

- Shortfall: $15,000-30,000

What they cut:

- EDI integration → Manual order processing: 3-4 hours daily = $15,000-20,000 annually in labor

- Platform-specific content → Copy-paste Amazon listings: 30-40% lower conversion rates = $150,000-200,000 in lost revenue

- Fulfillment infrastructure → Ad-hoc shipping: Retail carrier rates ($9-12 vs. $5-7 negotiated) = $800-1,000+ monthly overruns

- Returns process → Reactive handling: 2-3 hours weekly firefighting

Total cost of underbudgeting: $165,000-220,000 (lost revenue + inefficiency + overruns)

The $15,000-30,000 they "saved" cost them $165,000-220,000 in actual losses.

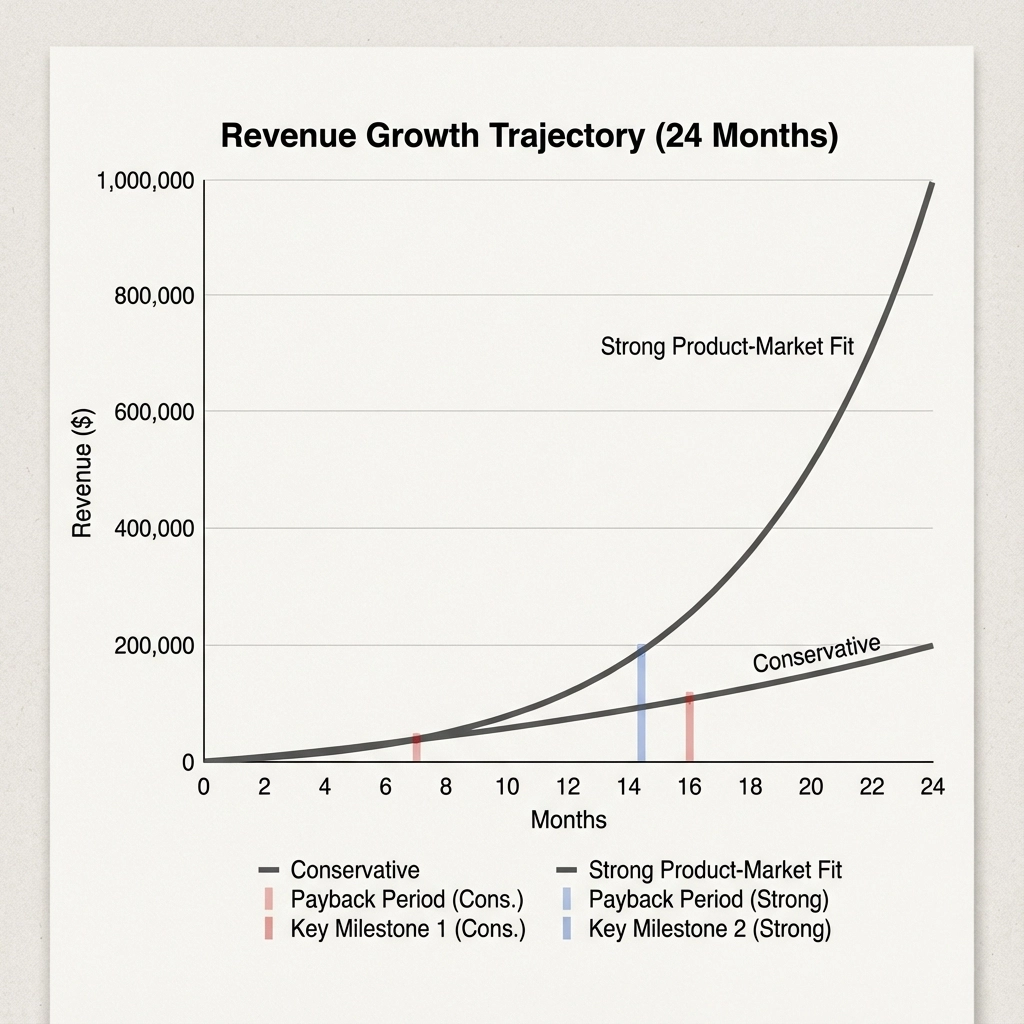

The ROI Timeline (Properly Executed .com Launch)

Realistic revenue projection (20-SKU line, both platforms):

- Conservative scenario: Year 1: $350,000-500,000 / Year 2: $600,000-800,000

- Strong product-market fit: Year 1: $600,000-900,000 / Year 2: $1,000,000-1,500,000

Client Case Study - Lighting Manufacturer:

- Starting point: 100% Amazon-dependent

- Year 1 retail .com: $800,000 (Home Depot, Lowe's, Zoro combined)

- Year 2: $2,000,000

- First-year investment: ~$62,000

- ROI: $800,000 revenue on $62,000 investment = 12.9x first-year return

With proper execution, HomeDepot.com or Lowes.com should deliver 8-14 month payback for a well-positioned product line.

When .com Makes More Sense Than Physical Retail

Choose .com vendor programs if:

- You already fulfill DTC or Amazon FBM orders (leverage existing infrastructure)

- You have under $50,000 available for setup costs

- You can't meet $8M insurance requirements (Home Depot stores/DC)

- Your products are higher-price, lower-velocity (better fit for online)

- You want to test market fit before committing to physical retail

Choose physical retail (stores/DC) if:

- Your products are impulse buys or project-based purchases

- You have $65,000-85,000+ available for setup

- You can secure $8M liability insurance cost-effectively

- Your product velocity justifies shelf space

- You want to be where contractors shop in-person

Many brands use .com as proving ground: Launch on .com → demonstrate sales velocity → use that data to pitch physical retail buyers → expand to stores/DC with proven demand.

Real Client Cost Examples (.com Programs)

See How Lighting Hub Increased Revenue With A Strategic Product At Just The Right Time

READ THECASE STUDY →

Series Wrap-Up: The Complete Platform Decision

Part 1 covered customer profiles, onboarding paths, insurance barriers, and the decision framework for choosing between Home Depot and Lowe's.

Part 2 revealed operational barriers: EDI complexity, performance tracking, content requirements, inventory planning, and payment cycles.

Part 3 (this post) broke down the real costs for .com vendor programs: $35,000-50,000 for proper execution, plus $16,000-40,000 in working capital requirements.

The complete picture: .com vendor programs offer the most accessible entry point for Amazon sellers expanding into retail. Lower setup costs, no $8M insurance barrier, and leverage your existing fulfillment infrastructure: but you'll pay more per order in shipping and returns than physical retail programs.

Launch properly funded with realistic cost expectations, or you'll hemorrhage money through manual processes, shipping overruns, and poor conversion rates.

Ready to launch on .com the right way? Most brands underestimate .com vendor costs because they think "it's just like Amazon FBM." The platforms, customer expectations, compliance requirements, and payment terms are completely different.

We work with brands doing $500K+ annually on Amazon who want to diversify intelligently. Our .com vendor onboarding includes operational assessment, honest cost projection, platform selection, merchant access, and launch support to avoid the $15,000-30,000 in preventable mistakes most brands make on .com launches.