How to Sell To Amazon (Not On Amazon): The Seller Central Vendor Quest and Its Real-World Upside

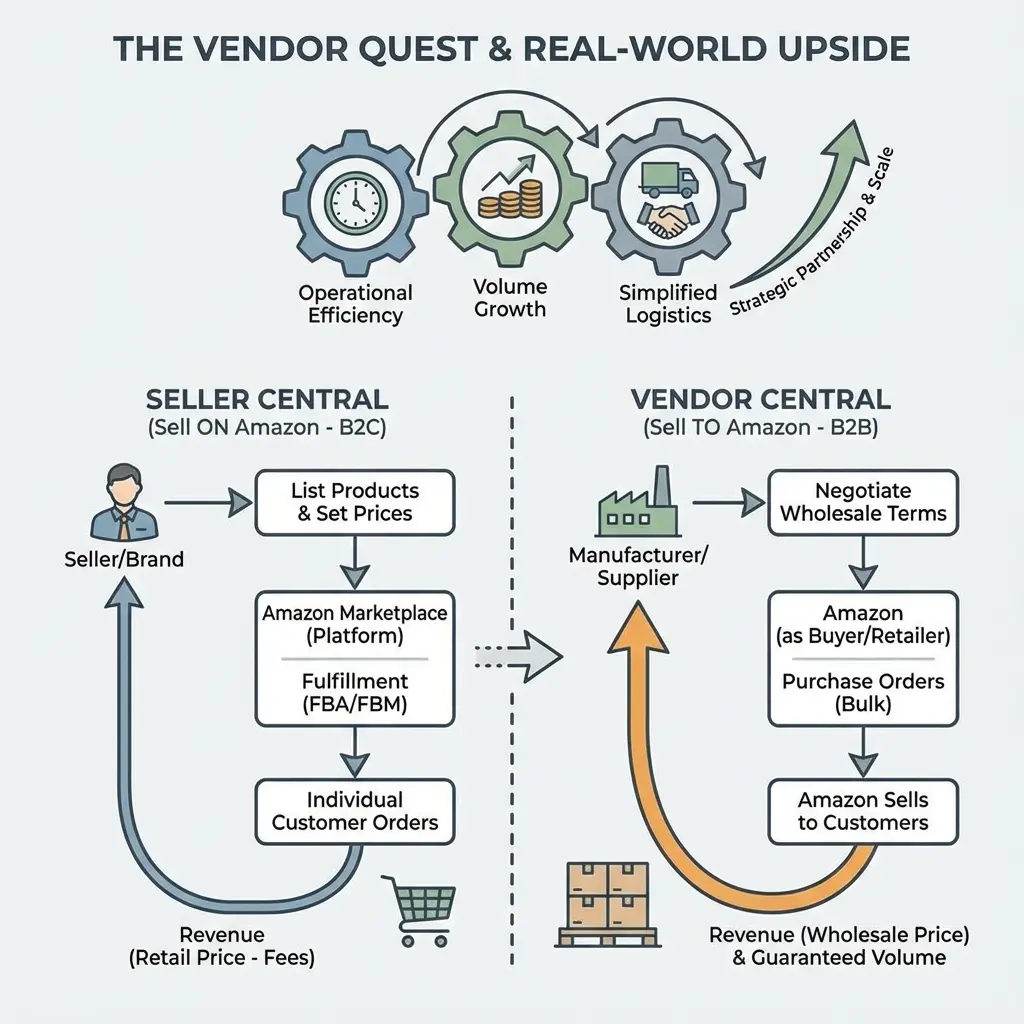

Most brands think selling to Amazon means setting up a Seller Central account and competing in the marketplace. But there's another path entirely: becoming Amazon's direct supplier through Vendor Central. Instead of selling on Amazon, you sell to Amazon: acting as their wholesale vendor rather than a third-party marketplace seller.

This distinction matters more than most operators realize. Vendor Central isn't just a different dashboard; it's a fundamentally different business model with distinct operational requirements, financial structures, and strategic implications.

The Vendor Central vs Seller Central Reality

With Seller Central, you maintain control over pricing, inventory management, customer service, and returns. You're essentially renting storefront space on Amazon's platform, handling direct-to-consumer operations while competing with other sellers for visibility and buy box placement.

Vendor Central flips this relationship. You become Amazon's supplier, selling inventory in bulk at negotiated wholesale prices. Amazon handles pricing decisions, customer interactions, returns processing, and retail operations. Your products appear as "Ships from and sold by Amazon.com" rather than your brand name.

Key Difference: Seller Central makes you a retailer using Amazon's platform. Vendor Central makes you a wholesaler supplying Amazon's retail operation.

This shift affects everything from cash flow timing to margin structure to operational complexity. Most importantly, it changes your relationship with Amazon from tenant to business partner.

The Invitation-Only Barrier

The biggest obstacle to Vendor Central isn't operational readiness: it's access. Historically, Vendor Central has been invitation-only with no public application. There isn't a standard form to submit or a checklist that guarantees entry. Strong Seller Central performance can help your brand show up on Amazon's radar, but it doesn't automatically convert to vendor status.

Amazon extends invitations based on internal priorities that are intentionally opaque. High-performing Seller Central accounts sometimes receive outreach, and trade show conversations can lead to follow-ups. Separately, new pathways, creative routes, or strategic partnerships occasionally create opportunities to sell to Amazon without a traditional, direct Vendor Central invite. Details shift over time, so treat this as an evolving landscape rather than a fixed playbook.

The invitation process typically involves contact from an Amazon vendor manager or business development representative. These conversations start with basic questions about your product catalog, manufacturing capacity, and willingness to operate under wholesale terms. Initial contact is useful signal, not a guarantee: Amazon evaluates vendor relationships based on strategic fit, category needs, and operational capabilities.

Reality Check: There is no guaranteed formula for Vendor Central access. Amazon's criteria are selective and not fully transparent. Keep your operations vendor-ready and remain open to emerging ways to sell to Amazon, whether through direct invitations or other legitimate routes.

Some operators try to accelerate access by networking with category teams. Results vary and timelines are unpredictable, so treat outreach as one of several parallel efforts while you continue building capabilities and staying alert to new options.

The Vendor Central Upside

Despite access limitations, Vendor Central offers advantages that marketplace sellers can't replicate through Seller Central optimization alone.

Enhanced Platform Control

Vendor status provides superior control over brand representation compared to Seller Central accounts. Vendors sit at the top of Amazon's brand hierarchy, giving them final authority over product listings, images, copy, and catalog structure. Even brand-registered Seller Central accounts face situations where Amazon or other sellers modify listings without permission. Vendors maintain primary control over these elements.

This control extends to promotional opportunities unavailable to most marketplace sellers. Vendors can submit products for Amazon's Today's Deals page: one of the platform's highest-traffic destinations after the homepage. Lightning deals, Best Deals, and other promotional programs prioritize vendor inventory over marketplace listings.

Direct Relationship Management

Vendor accounts include assigned consultants who provide strategic guidance on catalog expansion, sales optimization, and account growth. These aren't automated support interactions: vendors receive scheduled calls with dedicated Amazon representatives who understand their specific business needs and category dynamics.

Payment terms become negotiable rather than fixed. While Seller Central operates on standardized fee structures and payment schedules, vendors negotiate wholesale pricing, payment timing, damage allowances, and promotional investment directly with Amazon.

Operational Simplification

Vendor relationships eliminate marketplace management complexity. You don't monitor buy box status, manage customer reviews, or optimize for search rankings. Amazon handles customer acquisition, pricing strategy, and customer service operations. Your focus shifts to wholesale fulfillment and supply chain management.

Strategic Advantage: Vendor Central transforms your Amazon relationship from competitive marketplace presence to partnership-based wholesale operation.

The Vendor Central Tradeoffs

These advantages come with significant operational and financial constraints that many operators underestimate.

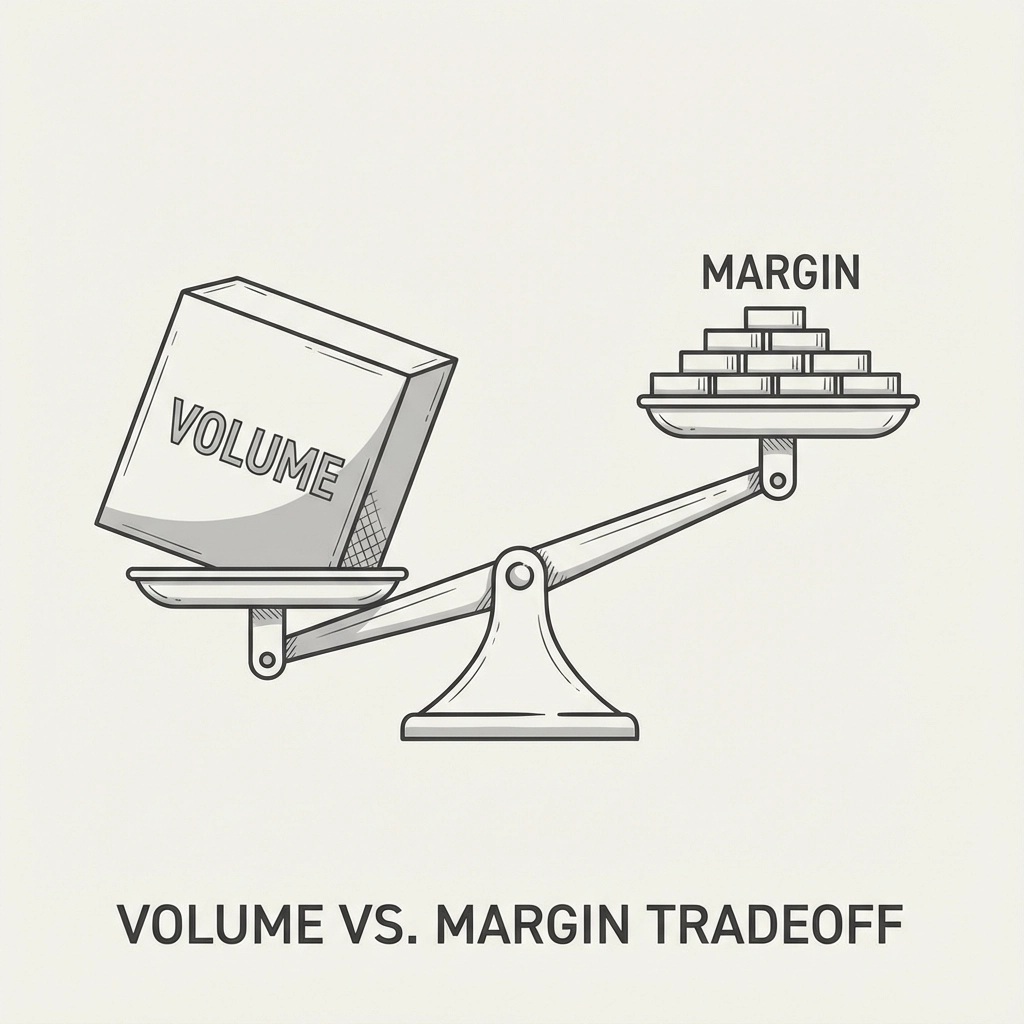

Margin Pressure and Pricing Control

Amazon negotiates wholesale prices based on their retail pricing targets, not your cost structure or margin requirements. If Amazon determines your wholesale prices don't support their competitive positioning, they'll request reductions or potentially discontinue products entirely. You lose direct control over consumer pricing: Amazon sets retail prices based on competitive analysis and internal algorithms.

Chargebacks represent another financial risk. Vendor Central includes penalties for operational failures including late shipments, incorrect quantities, labeling errors, and compliance violations. These chargebacks can reach thousands of dollars per incident and compound quickly if operational processes aren't robust.

Compliance and Operational Complexity

Vendor relationships require enterprise-level operational discipline. Amazon expects predictable inventory levels, consistent order fulfillment, accurate product data, and proactive communication about supply chain disruptions. Poor performance can result in account termination and substantial financial penalties.

Purchase order management becomes critical. Amazon generates POs based on demand forecasting and inventory models, but vendors remain responsible for fulfillment accuracy and timing. Mistakes here affect Amazon's customer experience directly, making them less tolerant of operational issues compared to marketplace seller problems.

Loss of Customer Relationship

As a vendor, you lose direct customer interaction entirely. Amazon owns the customer relationship, handles support requests, and controls review management. This separation limits your ability to build brand loyalty or gather direct customer feedback for product development.

Financial Reality: Vendor Central typically produces higher volume but lower per-unit margins compared to optimized Seller Central operations.

When Vendor Central Makes Strategic Sense

The vendor model works best for operations that can absorb margin pressure in exchange for volume scalability and operational simplification. This typically includes:

Established Manufacturing Operations

Companies with significant production capacity who can fulfill large, predictable orders efficiently. Amazon's volume can justify wholesale margins for manufacturers who struggle with customer acquisition costs in direct-to-consumer models.

Brand Extension Strategies

Brands seeking broader market penetration without investing in marketplace optimization, advertising management, or customer service operations. Vendor Central provides Amazon distribution without requiring marketplace expertise.

Portfolio Diversification

Operations already successful on Seller Central who want to test wholesale models while maintaining marketplace presence. Some vendors operate hybrid strategies, selling certain SKUs through Vendor Central while maintaining others on Seller Central.

However, Vendor Central rarely makes sense for small-scale operations, brands requiring high margins, or products that benefit from direct customer relationships and feedback loops.

Alternatives Worth Considering

Before pursuing the uncertain vendor invitation process, consider other retail channels that offer similar volume potential with more accessible entry requirements. Major retailers like Home Depot, Wayfair, and other national chains operate vendor programs with clearer application processes and qualification criteria. In parallel, keep an eye on emerging ways to sell to Amazon that may not rely on a direct Vendor Central invite; these options shift over time and are worth monitoring.

These alternatives often provide comparable volume opportunities without Amazon's opacity around acceptance criteria. They also allow you to develop wholesale operational capabilities that prepare you for eventual vendor relationships across multiple retail partners.

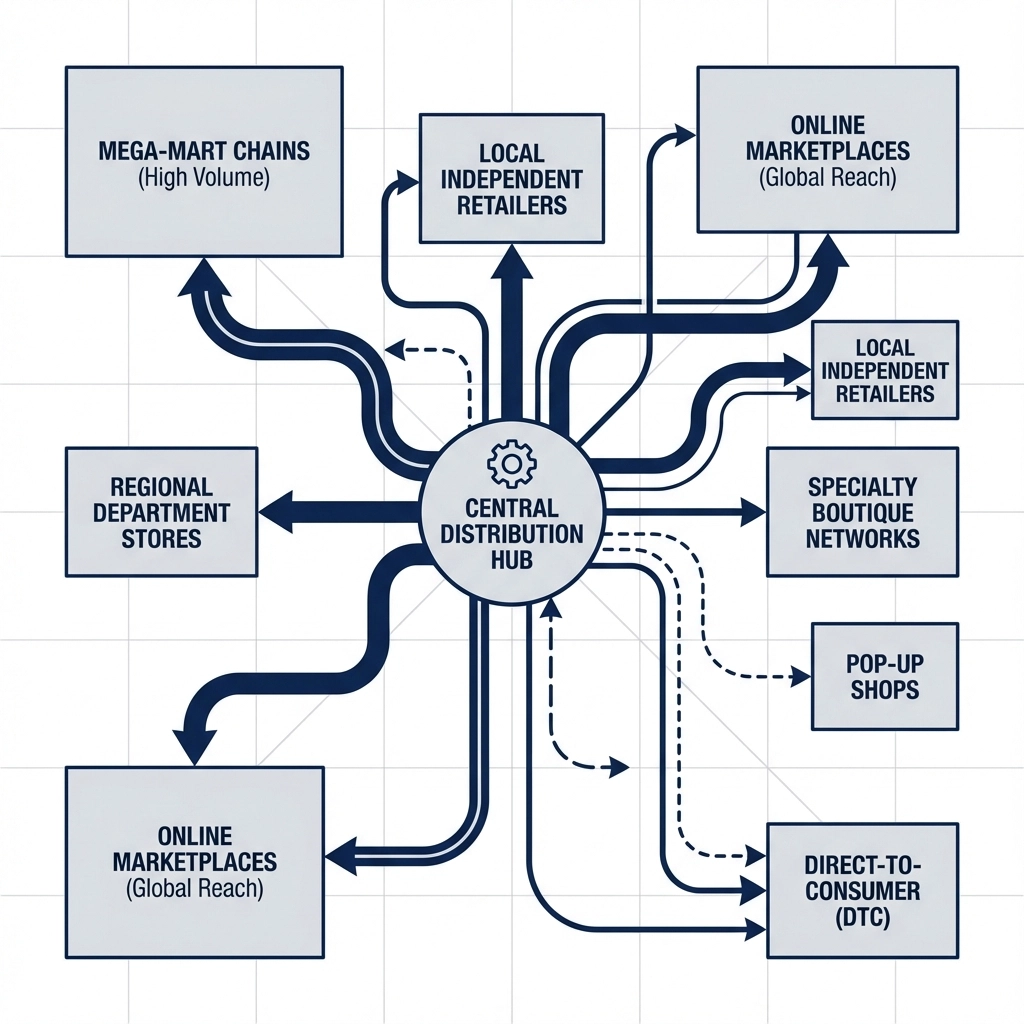

Building a multi-channel ecommerce strategy that includes diverse retail partnerships reduces platform dependence while developing the operational discipline that vendor relationships require. This approach often proves more sustainable than focusing exclusively on Seller Central optimization or passively waiting for a vendor invite, while you remain alert to emerging routes to sell to Amazon.

Strategic Perspective: Amazon Vendor Central is one wholesale path among many. Building vendor capabilities across multiple retail partners often produces better risk-adjusted returns than focusing exclusively on Amazon access, while keeping optionality if and when a path to selling to Amazon opens.

The vendor relationship with Amazon offers genuine advantages for operations that can navigate its constraints effectively. Enhanced platform control, promotional access, and simplified operations appeal to many sellers frustrated with marketplace competition and complexity.

At the same time, access remains selective and the model introduces margin pressure and operational rigor. Even strong Seller Central performance is not a guarantee. Occasionally, new pathways, creative routes, or strategic partnerships make it possible to sell to Amazon without a traditional, direct Vendor Central invite—so it's worth staying prepared and paying attention to how access evolves.

For most operators, building wholesale capabilities across multiple retail channels is the steadier way to compound growth, while exploring Amazon-oriented options in parallel as they arise. This approach develops the operational discipline vendor relationships require, reduces platform dependence, and creates multiple revenue streams.

Amazon Vendor Central is worth pursuing when it aligns with your economics and readiness. Treat it as one path among several—not the only plan you build around—while keeping optionality open as new routes emerge.