Tractor Supply Vendor Application Process: What Established Brands Need to Know

Tractor Supply operates differently than Amazon or most e-commerce platforms. Their vendor application process reflects this: it's more structured, relationship-driven, and frankly, more bureaucratic than what most online brands expect.

If you're considering expanding into TSC's e-commerce channel, understanding their vendor onboarding process upfront saves time and prevents false starts. The application isn't just about product fit; it's about demonstrating you can operate within their specific supply chain requirements.

Application Timeline: Work Backwards From Their Schedule

Tractor Supply runs vendor applications on a seasonal cycle, not rolling admissions. Their official application window opens February 10th and closes March 2nd. Accepted applicants get invited to pitch sometime after that.

This timeline creates a specific constraint: if you miss the February window through their standard process, you're waiting until next year. We've seen brands scramble to submit applications without proper preparation because they discovered this deadline too late.

The smarter approach is working backwards from TSC's buying calendar. Category merchants plan their online assortments 4-6 months before seasonal launches. Spring garden products get decided in fall. Holiday items get locked in by summer. If you understand when your category gets planned, you can time your approach to match their internal schedule, not just their public application window.

One appliance brand selling food dehydrators waited for the February application opening, submitted through official channels, and heard nothing for four months. When we identified their category merchant and reached out during fall planning season, we had a conversation scheduled within two weeks.

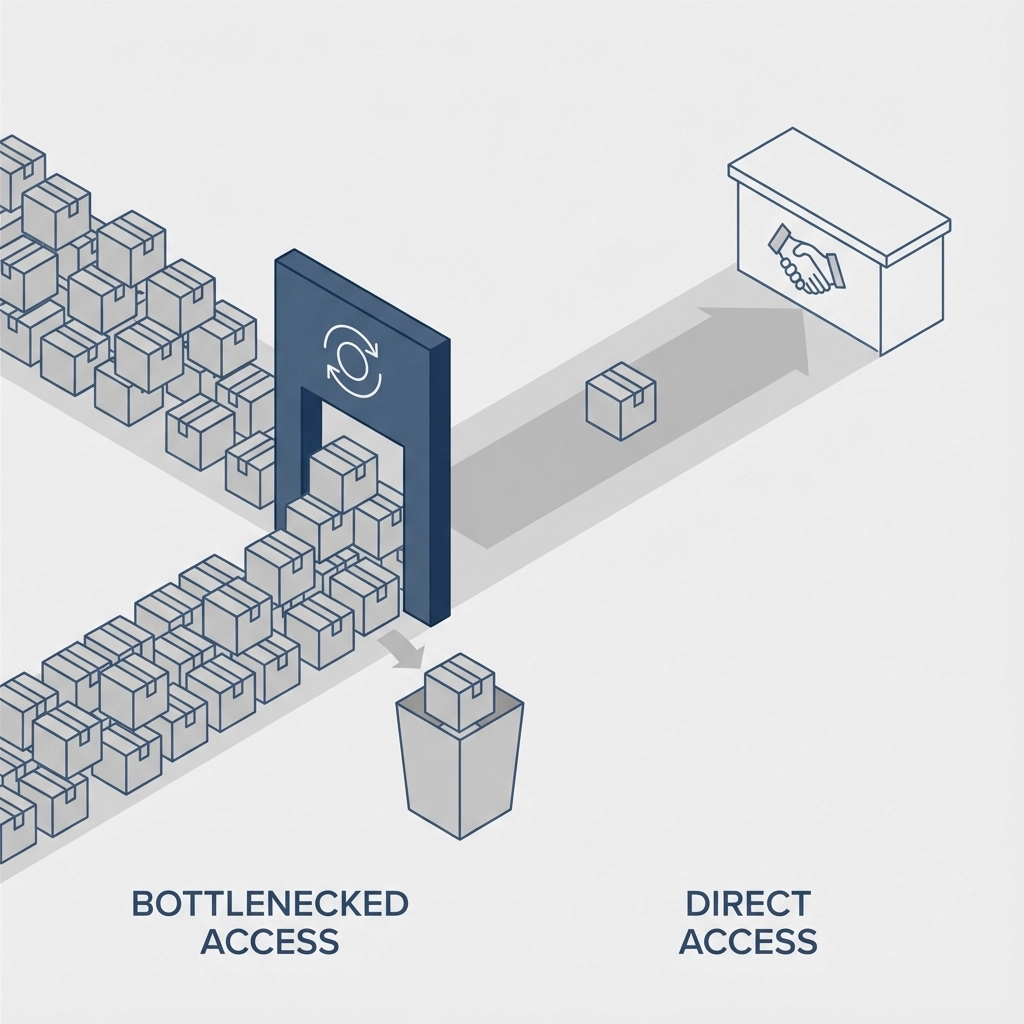

The Official Path: RangeMe and Its Limitations

Tractor Supply publicly states that RangeMe is their required vendor application portal. For brands applying cold without retail relationships, that's accurate. TSC buyers do use RangeMe for product discovery, and thousands of brands submit applications through this channel.

But RangeMe has limitations that most brands don't anticipate:

Queue Competition: You're competing with every other brand in your category who submitted through the same portal. Buyers filter heavily based on limited information visible in profiles. A great product can get overlooked simply because your two-paragraph description didn't communicate what the buyer needed to know.

Limited Context: RangeMe profiles don't let you discuss operational capabilities, address specific buyer concerns, or explain category positioning in real-time. You're presenting static information and hoping it aligns with what that specific buyer prioritizes.

Timeline Uncertainty: Brands submit and wait. Sometimes for weeks. Sometimes for months. You don't know if your submission got reviewed, filtered out, or lost in a queue of 200 other products in your category.

We've watched brands spend 6-8 months optimizing RangeMe profiles, adjusting product photos, rewriting descriptions: all while waiting for buyer response that never comes.

The Direct Approach: Category Merchant Relationships

TSC buyers still make purchasing decisions through direct evaluation and category planning meetings. Merchants manage specific product categories for TractorSupply.com and are actively looking for products that fill gaps in their online assortment or meet emerging customer demand.

Brands that understand TSC's merchant structure and seasonal buying cycles can often present directly to category buyers, bypassing the RangeMe queue entirely. This requires knowing:

- Which merchant manages your product category for their e-commerce channel

- What gaps exist in their online assortment

- When they're actively planning next season's buys

- What operational capabilities they prioritize for online-only vendors

> A mulch manufacturer spent six months refining their RangeMe profile: better photos, customer use case descriptions, detailed specifications. No response. After we identified their category merchant and secured a direct meeting during fall planning season, they had commitment for online launch within three weeks.

The difference wasn't product quality. The difference was timing, context, and direct conversation about operational capabilities that RangeMe profiles can't communicate.

Documentation Requirements: More Complex Than Expected

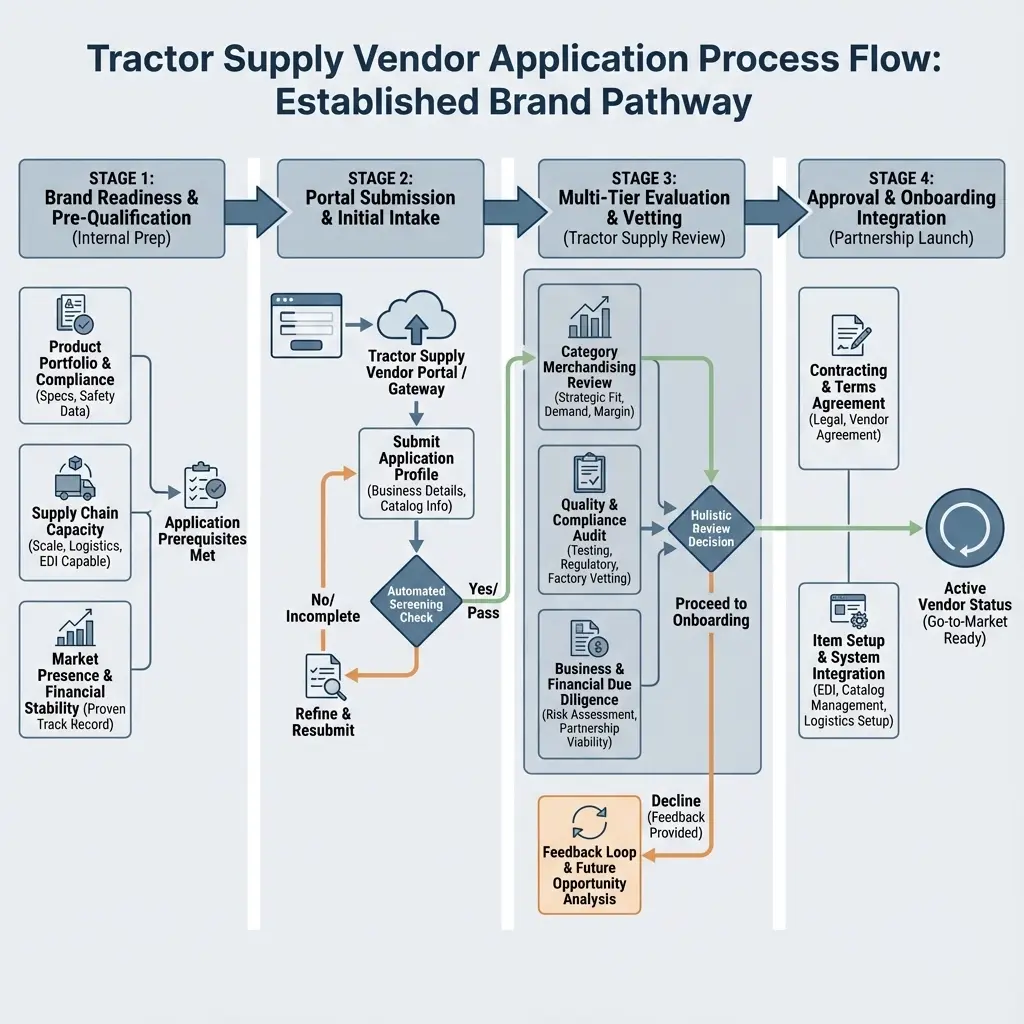

Once TSC shows interest: whether through RangeMe or direct merchant outreach: you enter their formal vendor onboarding process. This involves three mandatory documents that surprise most e-commerce brands:

Vendor Agreement (VA): This isn't a simple marketplace seller agreement. The VA establishes legal compliance requirements, ethical sourcing standards, and supply chain obligations that extend beyond typical e-commerce terms. The agreement includes specific provisions around product liability, compliance auditing, and operational standards that may require legal review.

Vendor Requirements Manual (VRM): Operational guidelines covering everything from EDI integration to return procedures. The VRM runs 20+ pages and includes specific requirements that may conflict with your existing fulfillment processes. Advance ship notice protocols, routing guide compliance, and data feed requirements can require operational changes if you're coming from seller-fulfilled Amazon or Shopify.

Vendor Setup Schedule: Comprehensive business information form that must be completed in full and signed by a company officer. This isn't delegation-friendly; TSC requires C-level or owner signature on specific sections.

The documentation review typically takes 2-4 weeks if submitted correctly and completely. Incomplete submissions reset the timeline. Budget 40-60 hours for complete documentation if you're handling it internally without retail operations experience.

A pest control brand, not a client of EDS, treated this like marketplace onboarding: delegated to their operations manager, submitted partial documentation, figured they'd clarify details later. Three weeks later, TSC sent the entire package back for resubmission. By the time they completed everything properly, they'd missed their category's seasonal buying window and had to wait six months for the next planning cycle.

How TSC E-Commerce Differs From Other Online Channels

Most brands approach TSC vendor applications using playbooks from Amazon, Wayfair, or Home Depot's online marketplace. This creates predictable problems because TSC.com operates on fundamentally different principles:

Curated Selection vs. Open Marketplace: TSC.com isn't an open marketplace where any approved seller can list products. Merchants curate their online assortment based on category strategy, brand positioning, and customer demographics. A product might perform well on Amazon but get rejected because TSC already has strong vendor relationships in that subcategory or because it doesn't fit their brand positioning.

Rural Customer Base: TractorSupply.com serves rural and suburban customers with different purchasing patterns than Amazon or Wayfair shoppers. Products that work well for urban consumers may not align with TSC's customer demographics.

Seasonal Buying Cycles: TSC plans online inventory around agricultural and seasonal patterns: spring planting, fall harvest, winter preparation. Their buyers think in terms of seasonal categories, not year-round sales velocity.

Integration with Physical Stores: Unlike pure e-commerce platforms, TSC.com functions as part of their omnichannel strategy. Products need to make sense for customers who are comparing online options with what they see in local stores.

Tractor Supply operates as a curated retail channel with category merchants who strategically select products based on brand positioning and rural customer demographics, not an open marketplace where any approved seller can list. Their buying decisions center on seasonal agricultural patterns and omnichannel store integration rather than year-round online sales velocity.

Common Application Roadblocks

Merchant Contact Identification: Most brands struggle here because TSC doesn't publicly list merchant assignments by category. Understanding who manages lawn care versus power tools versus automotive for their e-commerce channel isn't straightforward. RangeMe submissions get routed generically, which adds weeks or months to the process.

Compliance Capabilities: The VA and VRM include requirements around supply chain transparency, ethical sourcing, and operational compliance that some smaller brands can't immediately meet. TSC takes these requirements seriously: non-compliance can terminate vendor relationships even after successful launch.

EDI and System Integration: TSC requires EDI capability for order processing, inventory updates, and advance ship notices. Brands operating on Shopify or basic Amazon seller accounts often don't have EDI infrastructure in place. Setting this up: either through direct integration or EDI service providers: adds cost and complexity that catches brands off guard.

Fulfillment Speed Requirements: TractorSupply.com has specific fulfillment speed expectations that differ from Amazon's seller-fulfilled timelines. Products need to ship within 24-48 hours of order placement, and TSC tracks fulfillment metrics closely.

Most brands underestimate TSC's operational complexity: finding the right category merchant isn't straightforward, EDI infrastructure can cost $4,500+ to set up, and compliance requirements around supply chain transparency can disqualify smaller operations. The 24-48 hour fulfillment speed requirements and strict operational standards catch e-commerce brands off guard, especially those accustomed to Amazon's seller-fulfilled timelines.

The Real Decision: Is TSC Worth the Operational Investment?

The most important question isn't whether TSC will accept your products. It's whether TSC expansion supports your overall channel strategy or creates operational complexity that outweighs the revenue opportunity.

✅ TSC Works Well For:

- ✓ Brands with retail channel experience who understand buyer relationships

- ✓ Operations teams that can handle EDI and system integration requirements

- ✓ Fulfillment capabilities for 24-48 hour shipping

- ✓ Products aligned with rural/suburban customer demographics

- ✓ Inventory capacity to commit stock to TSC without starving other channels

⚠️ TSC Creates Problems For:

- ✗ Brands still building basic e-commerce operations

- ✗ Companies without budget for $4,500+ EDI and infrastructure investments

- ✗ Operations that can't meet fulfillment speed requirements consistently

- ✗ Products primarily targeted at urban consumers

- ✗ Brands already inventory-constrained across existing channels

If you're evaluating TSC alongside other e-commerce expansion options, understand that TSC operates more like a traditional retail partnership than an open marketplace. The operational requirements are higher, the relationship is more structured, and the timeline is longer: but for brands that fit their customer base and can meet their operational standards, the revenue potential justifies the investment.

Before applying, evaluate whether your product mix, operational capabilities, and business size align with TSC's e-commerce requirements. This isn't just about product-market fit; it's about operational compatibility. If you're doing $300K annually on Amazon with basic seller-fulfilled operations, TSC's infrastructure requirements might be premature. If you're doing $2M+ with existing retail channel experience, TSC becomes more operationally feasible.

Navigating Tractor Supply's vendor process is complex—but you don't have to figure it out alone.

We've written a comprehensive guide covering infrastructure setup, inventory planning, and fulfillment requirements that most brands miss.