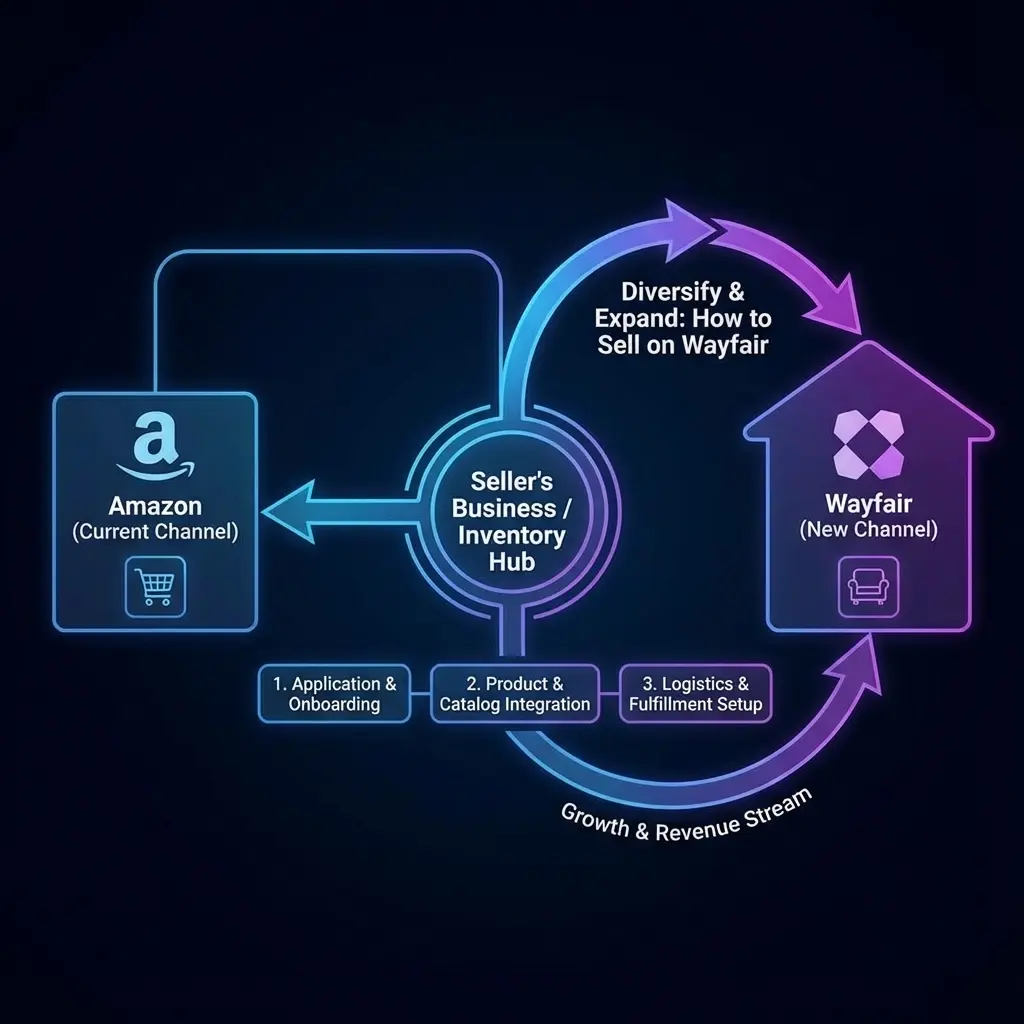

How to Sell on Wayfair: The Complete Guide for Amazon Sellers Ready to Diversify

Wayfair has been actively modernizing PartnerHome — the seller portal and catalog infrastructure. The work has centered on item build flow, attribute validation, variant handling, inventory enforcement, and schema/data hygiene. If you arrived with an Amazon-style bulk-template mindset, you ran straight into stricter gates that stop bad data before it ever lists.

There was no mysterious algorithmic reset, content penalty, or sudden lurch in ranking logic. The shift is operational: tighter catalog hygiene, more aggressive error-checking, and enforcement of inventory and variant rules. Items that would have limped live in 2023 now fail fast, get suppressed, or never publish.

If you're an Amazon seller looking to diversify, Wayfair is still one of the best opportunities in home goods — it reports 22 million active customers (as of Q2 2025) — but only if you treat it like a retailer-grade catalog system, not an open marketplace with forgiving ingestion.

Why Amazon Tactics Fail on Wayfair

Amazon trains teams to ship data fast and fix it live. Titles get stuffed, attributes get inferred, and bulk uploads win by volume. On PartnerHome, that approach hits hard stops: required attributes must validate, variant families must follow defined sets, and inventory feeds must pass enforcement checks. The failure mode isn’t “low SEO weight” — it’s “SKU rejected, suppressed, or non-purchasable.”

An Amazon-first vendor attempted a 900+ SKU bulk import using their Amazon flat-file mapping. PartnerHome flagged missing required attributes (Finish, Primary Material, Certification), rejected multiple variant families for option mixing, and left a subset non-purchasable due to an EDI inventory validation error. Onboarding paused until they rebuilt the schema and corrected the feed.

A separate furniture brand lost the Wayfair buy box on 28 active SKUs after PartnerHome flagged inconsistent lead times and a 2.6% short-ship rate pulled from their OMS logs. Nothing in their content changed. The signal was operational risk, and enforcement kicked in until they tightened ATP logic and packaging QA.

The operational difference: Amazon tolerates messy catalogs; PartnerHome enforces clean data and reliable execution.

The Visual Story Revolution

Strong visuals still matter — for conversion, for merchandising teams, and for customer confidence — but they won’t rescue broken data. PartnerHome will block or suppress items with schema errors, missing attributes, or invalid variant sets regardless of photo quality. Get the catalog clean, then merchandise.

Your primary product image should show the item in use and context, with secondary images building a coherent story. Treat imagery as the conversion layer once the listing is valid and purchasable, not as a lever to bypass validation.

> The New Wayfair Standard: Your image set should tell a complete story about how this product improves someone's home life, not just document what it looks like.

We tested this extensively with a lighting client. Their original Amazon-style images showed pendant lights against white backgrounds with technical detail shots. Conversion rate hovered around 0.8%. After switching to images that showed the same lights in designed kitchen spaces, bedroom settings, and dining rooms, conversion jumped to 2.3%.

But here's the operational challenge: lifestyle photography (in-room scenes) typically costs more than white-background silos. Treat the following as planning ranges, not guarantees: we often see per-SKU costs for lifestyle sets come in materially higher than basic silos, and final pricing varies by scope, props, location, and vendor. Build this variability into your margin model before launching.

The styling has to feel authentic, not staged. Wayfair customers can spot stock photography immediately. The most effective approach we've found is working with interior design photographers who understand spatial relationships and can make products feel integrated rather than placed.

Content Strategy: Curation Over Keywords

PartnerHome’s catalog schema and merchandising workflows reward clean, parsable data and coherent collections over keyword theatrics. Organize your catalog around design themes, use cases, and lifestyle segments so attributes map cleanly and buyers know where items fit.

Your product titles should be clean, descriptive, and brand-forward. "Meridian Walnut Coffee Table" performs better than "Modern Wood Coffee Table 48 Inch Living Room Furniture Walnut Brown Storage Drawers." Overstuffed titles break parsing, pollute attributes, and can trigger build/suppression issues.

Product descriptions should support design integration, while critical specs live in attributes. Instead of "Dimensions: 48"L x 24"W x 16"H, Weight capacity: 75 lbs, Assembly required," lead with "The Meridian collection brings warm walnut tones and clean lines to contemporary living spaces. This coffee table anchors seating areas while providing discrete storage for daily essentials." Keep dimensions, weight capacity, and assembly details in the proper fields so validation passes and filters work.

Collections become crucial. Group related products under unified design themes. If you're selling kitchen items, don't just list them individually: create collections like "Coastal Kitchen Essentials" or "Minimalist Prep Tools" that guide customers through complementary purchases.

We restructured a home decor client's entire catalog around five design aesthetic collections instead of traditional category browsing. Their average order value increased 40% because customers started buying coordinated items instead of single products.

The decision you face: maintain individual product optimization (easier to manage, lower performance) or invest in collection-based merchandising (more complex operationally, significantly better results).

Brand Presence vs. Product Listing

Amazon sellers often underestimate how much brand development matters on Wayfair. The platform gives significant preference to sellers who can demonstrate design authority and aesthetic consistency. Your brand needs to convey specific design expertise, not just product variety.

This showed up clearly when we compared two furniture clients launching simultaneously. One positioned themselves as "quality furniture at affordable prices": essentially competing on Amazon metrics. The other built their brand around "Scandinavian-inspired designs for urban apartments" with detailed content about design philosophy, material sourcing, and space optimization.

The generic brand struggled to gain traction despite competitive pricing and good product reviews. The design-focused brand achieved featured placement in multiple Wayfair collections and built a following of repeat customers. Same fulfillment capabilities, similar product quality, completely different brand positioning results.

Your brand story needs to connect directly to specific design problems. "We create storage solutions for small-space living" gives Wayfair's merchandising team a clear reason to feature your products in relevant collections. "We make quality furniture" tells them nothing useful.

Operational Realities After the Platform Changes

The application process is more selective — and the real friction now lives in PartnerHome’s gates. Expect stricter item build templates, required attribute checks, and variant set conformance before a SKU can publish. Teams that treat Wayfair like a product dump will fail the intake, not the “algorithm.”

Once approved, onboarding is a data exercise first. Clean attribute mapping, valid variant families, UPC/GTIN consistency, compliant imagery specs, and a working inventory/EDI connection are prerequisites. Plan for a dry run in a staging catalog and a QA pass before you push volume. While Wayfair doesn't charge listing fees, sellers should factor in potential allowances and holdbacks for returns and damages when calculating margins.

Inventory enforcement is real. Noncompliant ATP, volatile lead times, or short-ship/damage patterns will suppress items or pull the buy box until the signals improve. We’ve seen a 7-SKU lighting launch oversell 23 units after a SkuVault to PartnerHome feed missed backorder rules; 19 SKUs were suppressed for 10 days while they corrected ATS logic and packaging.

Middleware matters. If you’re using Acenda, Listing Mirror, or a custom EDI, test attribute transforms and 204/846/850 message handling end-to-end. One home goods team ran ShipStation for OMS and kept timing out their 846; the feed looked “green” in their dashboard but PartnerHome showed stale ATP. The result: purchasable flags toggled off mid-promo.

Wayfair still curates. 500 SKUs won’t beat 50 clean, in-stock, well-positioned items when buyers plan promotions. Smaller, healthier catalogs earn placement and support faster than wide-but-brittle assortments.

Decision: Thin the assortment and invest in clean data and reliable ops (fewer listings, faster traction, lower suppression risk) or keep breadth (more surface area, but higher failure rate at the gates and lower trust signals).

Making the Strategic Decision

If you're currently generating significant revenue on Amazon, Wayfair offers genuine diversification benefits: but only if you're willing to rebuild your approach from the ground up. The investment in visual content, brand development, and curated merchandising typically runs $25K-50K for a meaningful launch. Expect to carry $1M product liability insurance; most sellers see $1,000–$3,000 annually depending on risk category.

The payoff timeline is longer than Amazon. In our experience, expect 6-9 months to build meaningful traction versus Amazon's typically faster ramp. Wayfair's published average order value is $300-328, but this varies significantly by category. Direct Amazon comparison data is unavailable.

Your decision comes down to whether you want to operate two different business models or stick with Amazon's volume-focused approach. Wayfair success requires design-focused thinking, premium positioning, and patient brand building. If you're optimized for quick launches and rapid iteration, the platform may not align with your operational strengths.

Practical close: Wayfair’s back-end modernization means disciplined data, fewer SKUs, cleaner catalogs, and operational readiness are now table stakes. If this is relevant to your situation, scope the work like an infrastructure project — not a marketing sprint.